Other questions asked by students

A machine that produces a special type of transistor (a component of computers) has a 10%...

3 The potential of the electric field at any point x y z is given...

and o 88 a 8 n 64 Determine from the given parameters of the population...

According to the Corporations Act, a company is required to include which of the following...

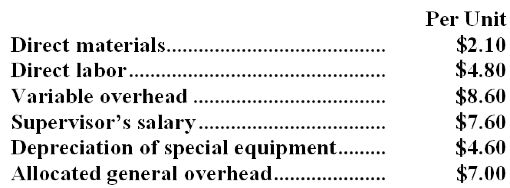

The chief cost accountant for Sassy Beverage Co. estimated that total factory overhead cost for...

Advanced Life Co. Is an HMO for businesses in the Albuquerque area. The following account...

1. Enrique Vaquero is a city planner for the city of Bradford in northeast Colorado....