Other questions asked by students

Finance

Civil Engineering

Basic Math

Algebra

Accounting

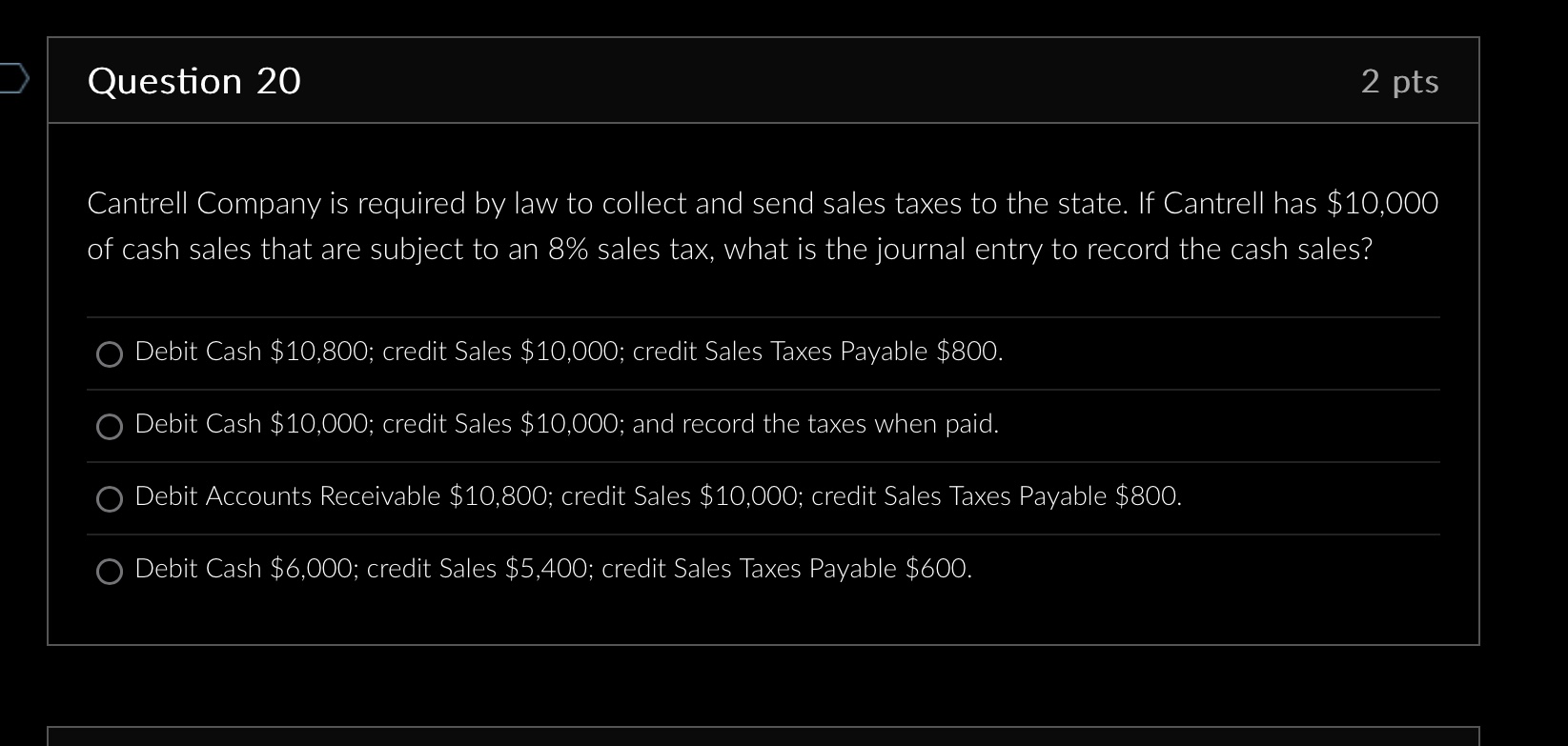

Cantrell Company is required by law to collect and send sales taxes to the state. If Cantrell has $10,000 of cash sales that are subject to an 8% sales tax, what is the journal entry to record the cash sales? Debit Cash \$10,800; credit Sales $10,000; credit Sales Taxes Payable $800. Debit Cash $10,000; credit Sales $10,000; and record the taxes when paid. Debit Accounts Receivable \$10,800; credit Sales \$10,000; credit Sales Taxes Payable \$800. Debit Cash $6,000; credit Sales $5,400; credit Sales Taxes Payable $600

Cantrell Company is required by law to collect and send sales taxes to the state. If Cantrell has $10,000 of cash sales that are subject to an 8% sales tax, what is the journal entry to record the cash sales? Debit Cash \$10,800; credit Sales $10,000; credit Sales Taxes Payable $800. Debit Cash $10,000; credit Sales $10,000; and record the taxes when paid. Debit Accounts Receivable \$10,800; credit Sales \$10,000; credit Sales Taxes Payable \$800. Debit Cash $6,000; credit Sales $5,400; credit Sales Taxes Payable $600