Other questions asked by students

Medical Sciences

Programming

Basic Math

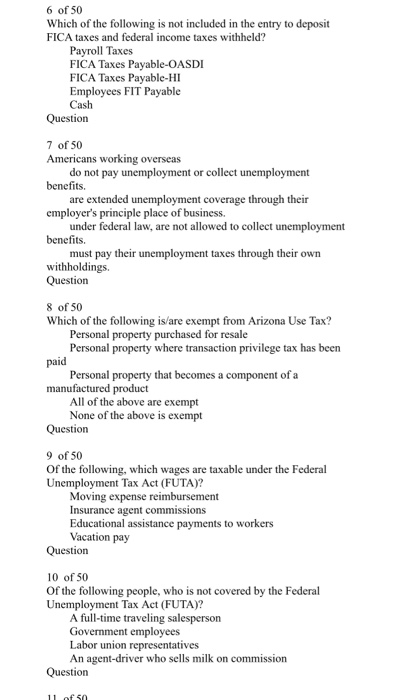

Accounting

Accounting

Accounting