Other questions asked by students

Basic Math

Medical Sciences

Geometry

Basic Math

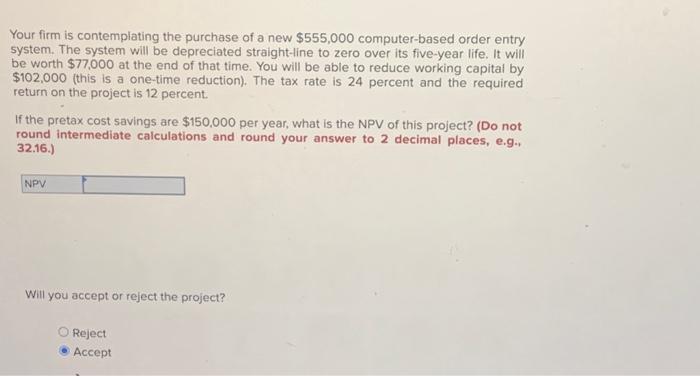

Accounting

Accounting