Other questions asked by students

Electrical Engineering

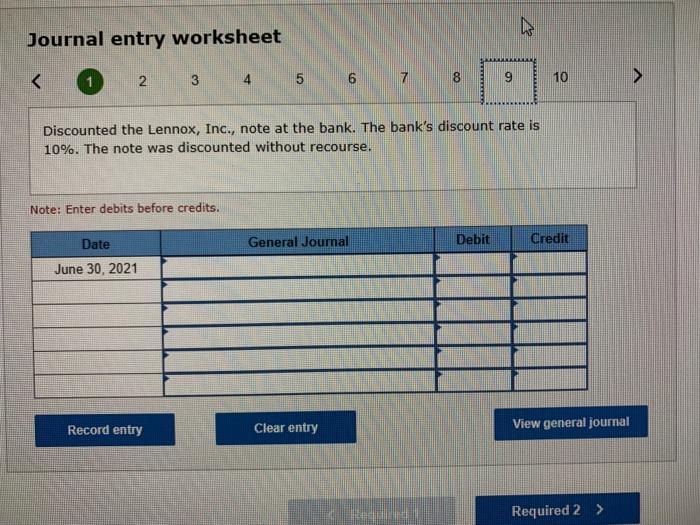

Accounting

Q

An equilateral triangle is inscribed in a circle Use your knowledge of equilateral triangles to...

Geometry

Accounting

Accounting

Accounting