Other questions asked by students

Geometry

Q

How do we write regulations of any electronic health records for any industry in general and how...

Operations Management

Basic Math

Accounting

Accounting

Accounting

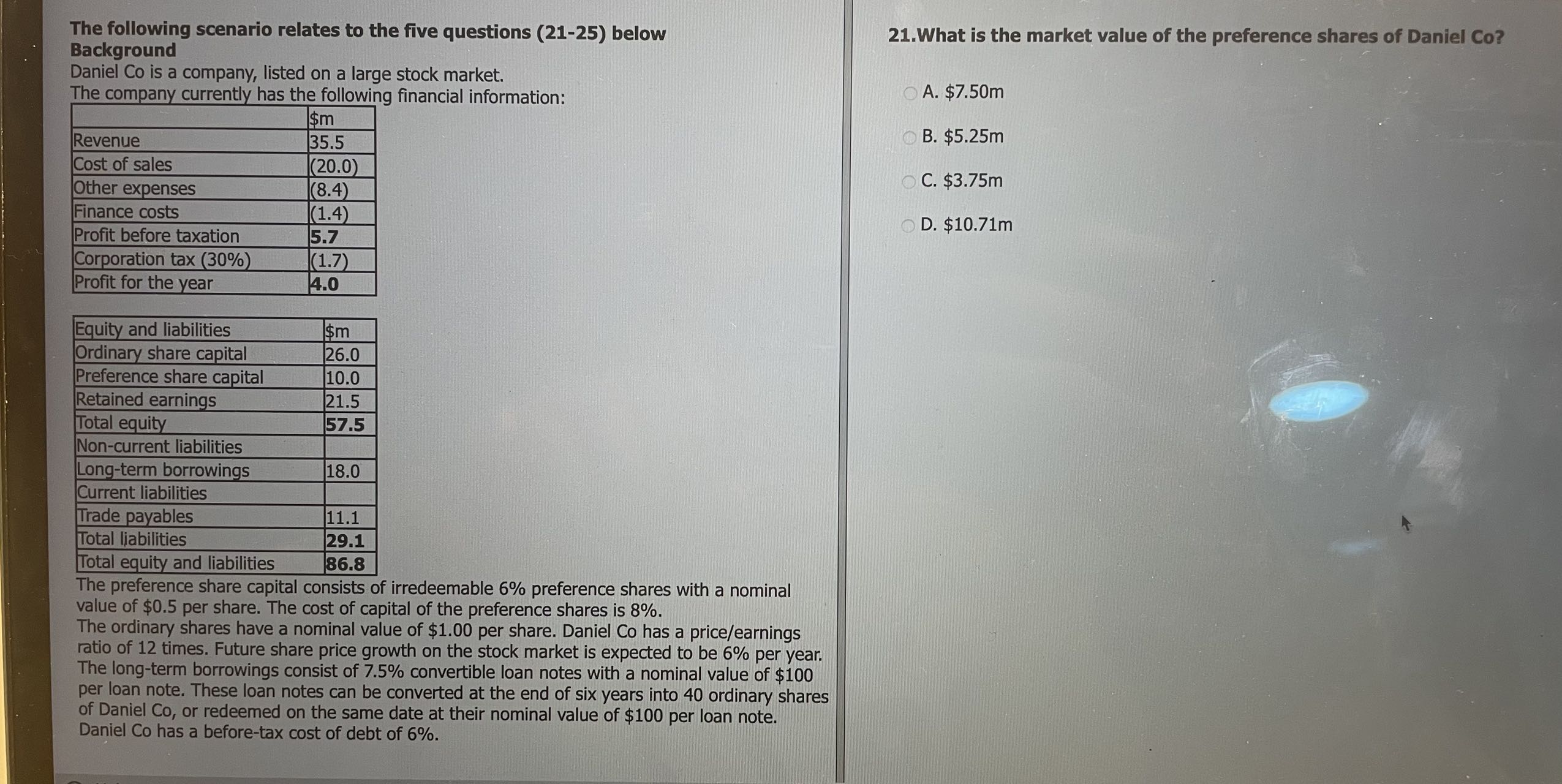

The following scenario relates to the five questions (2125) below Background Daniel Co is a company, listed on a large stock market. The company currentlv has the following financial information: 21. What is the market value of the preference shares of Daniel Co? A. $7.50m B. $5.25m C. $3.75m D. $10.71m Ine preference share capital consists of irredeemable 6% preference shares with a nominal value of $0.5 per share. The cost of capital of the preference shares is 8%. The ordinary shares have a nominal value of $1.00 per share. Daniel Co has a price/earnings ratio of 12 times. Future share price growth on the stock market is expected to be 6% per year. The long-term borrowings consist of 7.5% convertible loan notes with a nominal value of $100 per loan note. These loan notes can be converted at the end of six years into 40 ordinary shares of Daniel Co, or redeemed on the same date at their nominal value of $100 per loan note. Daniel Co has a before-tax cost of debt of 6%

The following scenario relates to the five questions (2125) below Background Daniel Co is a company, listed on a large stock market. The company currentlv has the following financial information: 21. What is the market value of the preference shares of Daniel Co? A. $7.50m B. $5.25m C. $3.75m D. $10.71m Ine preference share capital consists of irredeemable 6% preference shares with a nominal value of $0.5 per share. The cost of capital of the preference shares is 8%. The ordinary shares have a nominal value of $1.00 per share. Daniel Co has a price/earnings ratio of 12 times. Future share price growth on the stock market is expected to be 6% per year. The long-term borrowings consist of 7.5% convertible loan notes with a nominal value of $100 per loan note. These loan notes can be converted at the end of six years into 40 ordinary shares of Daniel Co, or redeemed on the same date at their nominal value of $100 per loan note. Daniel Co has a before-tax cost of debt of 6%