Other questions asked by students

Q

1.Find the equation of the tangent to x=t^2-t, y=t^2+t+1, at the point t=1 2.Find the length of...

Basic Math

Biology

Physics

Mechanical Engineering

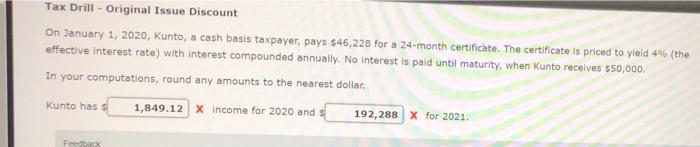

Accounting