Other questions asked by students

Electrical Engineering

Q

Summary Question An organism s stress response is a complex physiological phenomen which can be...

Biology

Biology

Accounting

Accounting

Accounting

Accounting

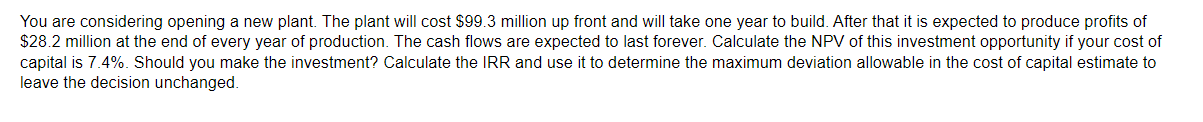

Solve the problem

Solve the problem