Other questions asked by students

Advance Math

Mechanical Engineering

Q

Determine whether the pair of lines are parallel, perpendicular, or neither.2x-5y +3=0 and 15y =...

Basic Math

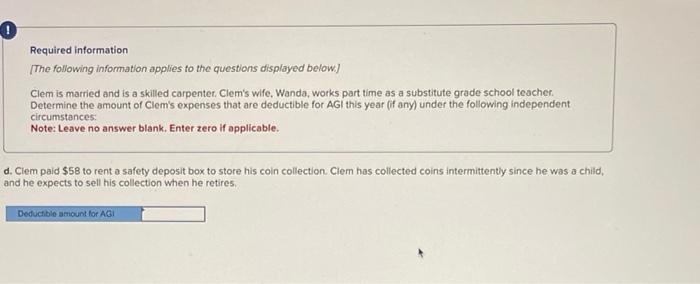

Accounting