Other questions asked by students

Finance

Medical Sciences

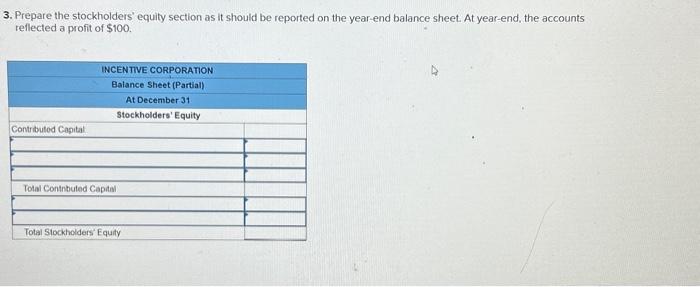

Accounting

Accounting

Accounting