70.2K

Verified Solution

Link Copied!

Link Copied!

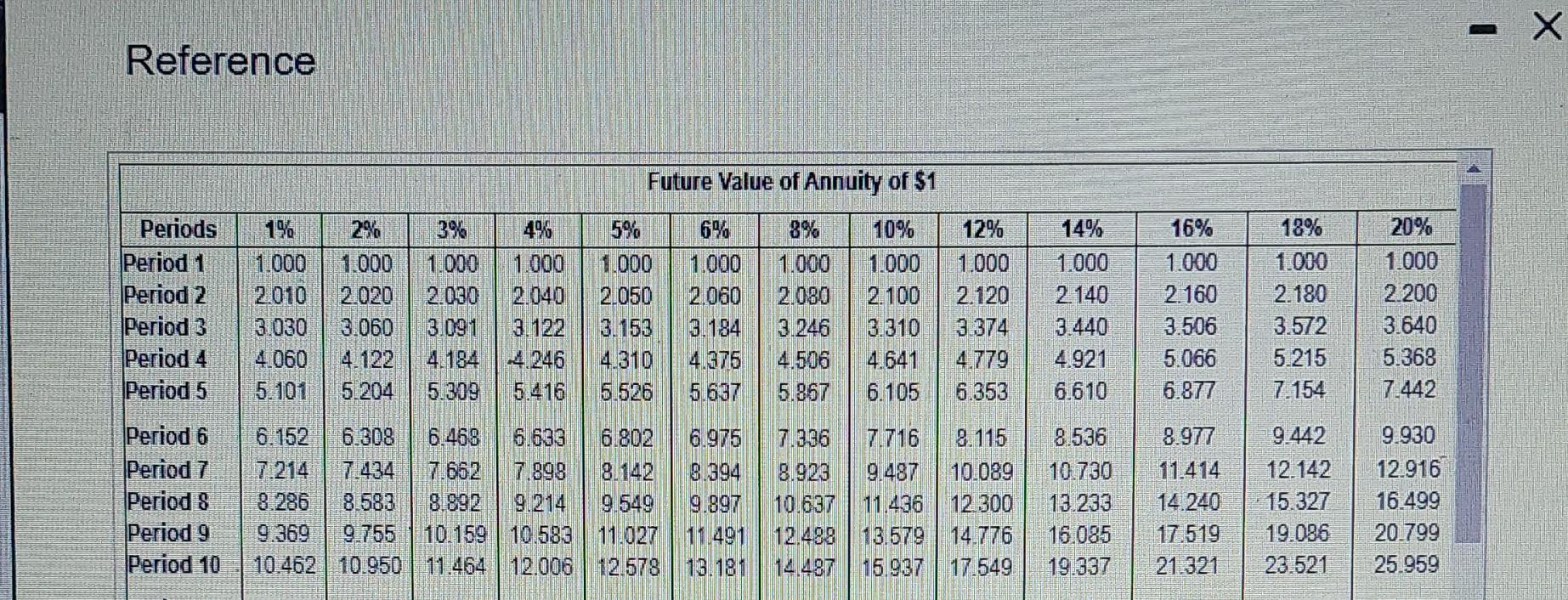

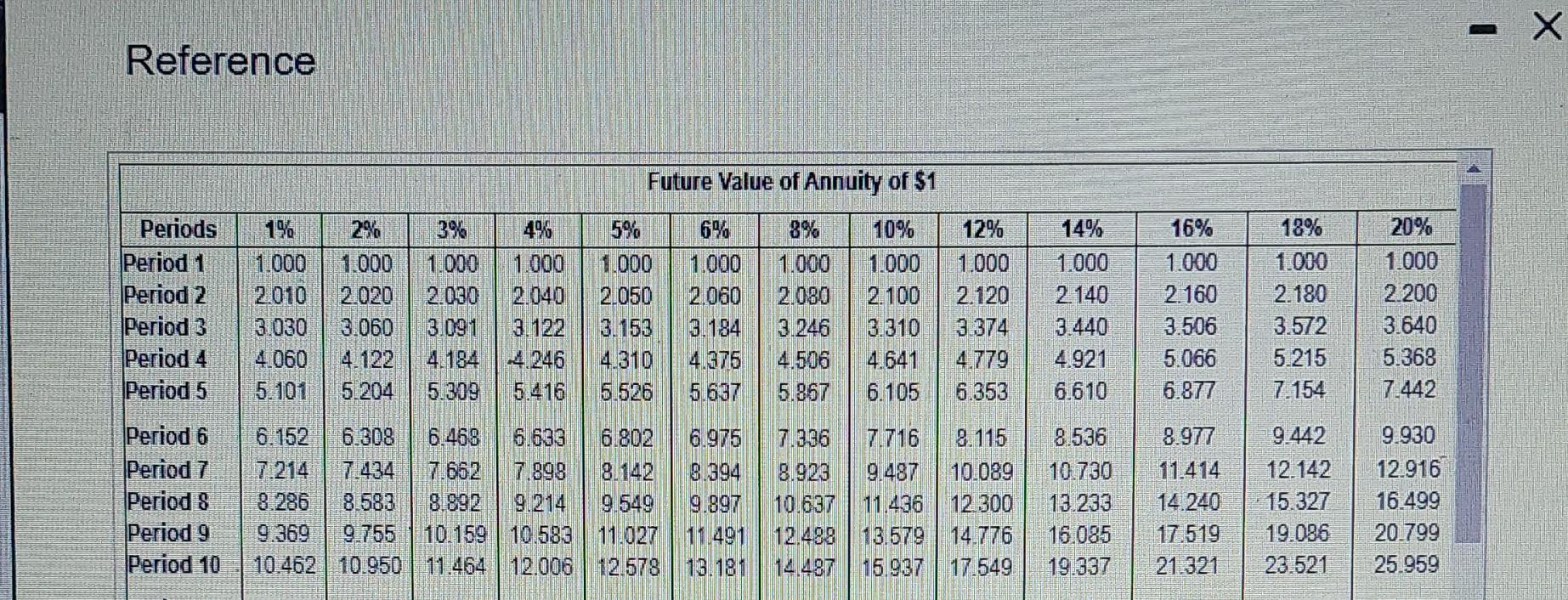

Reference Reference Reference Denton Music is considering investing $725,000 in private lesson studios that will have no residual value. The studios are expected to result in annual net cash inflows of $105,000 per year for the next nine years. Assume that Denton Music uses a 10% hurdle rate. What is the approximate internal rate of return (IRR) of the studio investment? (Click the icon to view the present value of an annuity table.) (Click the icon to view the present value table.) (Click the icon to view the future value of an annuity table.) (Click the icon to view the future value table.) Denton Music is considering investing $725,000 in private lesson studios that will have no residual value. The studios are expected to result in annual net cash inflows of $105,000 per year for the next nine years. Assume that Denton Music uses a 10% hurdle rate. What is the approximate internal rate of return (IRR) of the studio investment? (Click the icon to view the present value of an annuity table.) (Click the icon to view the present value table.) (Click the icon to view the future value of an annuity table.) (Click the icon to view the future value table.) \begin{tabular}{|l|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Period 11 & 11.567 & 12.169 & 12.808 & 13.486 & 14.207 & 14.972 & 16.645 & 18.531 & 20.655 & 23.045 & 25.733 & 28.755 & 32.150 \\ Period 12 & 12.683 & 13.412 & 14.192 & 15.026 & 15.917 & 16.870 & 18.977 & 21.384 & 24.133 & 27.271 & 30.850 & 34.931 & 39.581 \\ Period 13 & 13.809 & 14.680 & 15.618 & 16.627 & 17.713 & 18.882 & 21.495 & 24.523 & 28.029 & 32.089 & 36.786 & 42.219 & 48.497 \\ Period 14 & 14.947 & 15.974 & 17.086 & 18.292 & 19.599 & 21.015 & 24.215 & 27.975 & 32.393 & 37.581 & 43.672 & 50.818 & 59.196 \\ Period 15 & 16.097 & 17.293 & 18.599 & 20.024 & 21.579 & 23.276 & 27.152 & 31.772 & 37.280 & 43.842 & 51.600 & 60.965 & 72.035 \\ Period 20 & 22.019 & 24.297 & 26.870 & 29.778 & 33.066 & 36.786 & 45.762 & 57.275 & 72.052 & 91.025 & 115.380 & 146.628 & 186.688 \\ Period 25 & 28.243 & 32.030 & 36.459 & 41.646 & 47.727 & 54.865 & 73.106 & 98.347 & 133.334 & 181.871 & 249.214 & 342.003 & 471.981 \\ Period 30 & 34.785 & 40.568 & 47.575 & 56.085 & 66.439 & 79.058 & 113.283 & 164.494 & 241.333 & 356.787 & 530.312 & 790.948 & 1,181.88z \\ Period 40 & 48.886 & 60.402 & 75.401 & 95.026 & 120.800 & 154.762 & 259.057 & 442.593 & 767.091 & 1,342.025 & 2,360.757 & 4,163.213 & 7,343.85 \\ \hline \end{tabular} Reference \begin{tabular}{|l|c|c|c|c|c|c|c|c|c|c|c|c|c|} Period 11 & 10.368 & 9.787 & 9.253 & 8.760 & 8.306 & 7.887 & 7.139 & 6.495 & 5.938 & 5.453 & 5.029 & 4.656 & 4.327 \\ Period 12 & 11.255 & 10.575 & 9.954 & 9.385 & 8.863 & 8.384 & 7.536 & 6.814 & 6.194 & 5.660 & 5.197 & 4.793 & 4.439 \\ Period 13 & 12.134 & 11.348 & 10.635 & 9.986 & 9.394 & 8.853 & 7.904 & 7.103 & 6.424 & 5.842 & 5.342 & 4.910 & 4.533 \\ Period 14 & 13.004 & 12.106 & 11.296 & 10.563 & 9.899 & 9.295 & 8.244 & 7.36 & 6.628 & 6.002 & 5.468 & 5.008 & 4.611 \\ Period 15 & 13.865 & 12.849 & 11.938 & 11.118 & 10.380 & 9.712 & 8.559 & 7.60 & 6.811 & 6.142 & 5.575 & 5.092 & 4.675 \\ Period 20 & 18.046 & 16.351 & 14.877 & 13.590 & 12.462 & 11.470 & 9.818 & 8.514 & 7.469 & 6.623 & 5.929 & 5.353 & 4.870 \\ Period 25 & 22.023 & 19.523 & 17.413 & 15.622 & 14.094 & 12.783 & 10.675 & 9.077 & 7.843 & 6.873 & 6.097 & 5.467 & 4.948 \\ Period 30 & 25.808 & 22.396 & 19.600 & 17.292 & 15.372 & 13.765 & 11.258 & 9.427 & 8.055 & 7.003 & 6.177 & 5.517 & 4.979 \\ Period 40 & 32.835 & 27.355 & 23.115 & 19.793 & 17.159 & 15.046 & 11.925 & 9.779 & 8.244 & 7.105 & 6.233 & 5.548 & 4.997 \\ \hline \end{tabular} \begin{tabular}{l|c|c|c|c|c|c|c|c|c|c|c|c|c|} Period 11 & 1.116 & 1.243 & 1.384 & 1.539 & 1.710 & 1.898 & 2.332 & 2.853 & 3.479 & 4.226 & 5.117 & 6.176 & 7.430 \\ Period 12 & 1.127 & 1.268 & 1.426 & 1.601 & 1.796 & 2.012 & 2.518 & 3.138 & 3.896 & 4.818 & 5.936 & 7.288 & 8.916 \\ Period 13 & 1.138 & 1.294 & 1.469 & 1.665 & 1.886 & 2.133 & 2.720 & 3.452 & 4.363 & 5.492 & 6.886 & 8.599 & 10.699 \\ Period 14 & 1.149 & 1.319 & 1.513 & 1.732 & 1.980 & 2.261 & 2.937 & 3.797 & 4.887 & 6.261 & 7.988 & 10.147 & 12.839 \\ Period 15 & 1.161 & 1.346 & 1.558 & 1.801 & 2.079 & 2.397 & 3.172 & 4.177 & 5.474 & 7.138 & 9.266 & 11.974 & 15.407 \\ Period 20 & 1.220 & 1.486 & 1.806 & 2.191 & 2.653 & 3.207 & 4.661 & 6.727 & 9.646 & 13.743 & 19.461 & 27.393 & 38.338 \\ Period 25 & 1.282 & 1.641 & 2.094 & 2.666 & 3.386 & 4.292 & 6.848 & 10.835 & 17.000 & 26.462 & 40.874 & 62.669 & 95.396 \\ Period 30 & 1.348 & 1.811 & 2.427 & 3.243 & 4.322 & 5.743 & 10.063 & 17.449 & 29.960 & 50.950 & 85.850 & 143.371 & 237.376 \\ Period 40 & 1.489 & 2.208 & 3.262 & 4.801 & 7.040 & 10.286 & 21.725 & 45.259 & 93.051 & 188.884 & 378.721 & 750.378 & 1,469.772 \\ \hline \end{tabular}

Answer & Explanation

Solved by verified expert