PLEASE ANSWER THESE QUESTIONS DONT COPY FROM INTERNET SOURCE PLEASE IT SHOWS PLAG ...

50.1K

Verified Solution

Question

Accounting

PLEASE ANSWER THESE QUESTIONS

DONT COPY FROM INTERNET SOURCE PLEASE IT SHOWS PLAG

c)What KEY FACTORS may determine the success for Gap Inc.? Explain THREE in your answer.

d)Recommendations Make recommendations to solve any strategic problems/issues the company is facing.

What recommendations would you make to The Gaps top-management team to improve its competitiveness in the market while mitigating any current or future risks

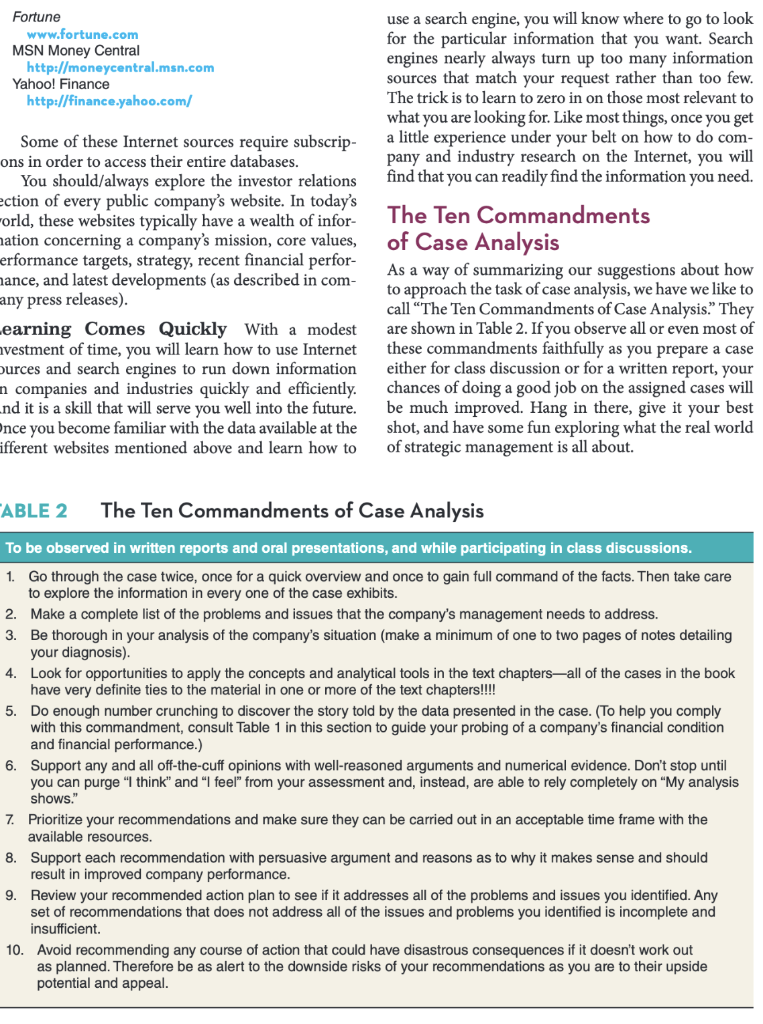

n most courses in strategic management, students use cases about actual companies to practice stra- tegic analysis and to gain some experience in the tasks of crafting and implementing strategy. A case sets forth, in a factual manner, the events and orga- nizational circumstances surrounding a particular managerial situation. It puts readers at the scene of the action and familiarizes them with all the relevant cir- cumstances. A case on strategic management can con- cern a whole industry, a single organization, or some part of an organization; the organization involved can be either profit seeking or not-for-profit. The essence of the student's role in case analysis is to diagnose and size up the situation described in the case and then to recommend appropriate action steps. WHY USE CASES TO PRACTICE STRATEGIC MANAGEMENT? A student of business with tact Absorbed many answers he lacked. But acquiring a job, He said with a sob, "How does one fit answer to fact?" The foregoing limerick was used some years ago by Professor Charles Gragg to characterize the plight of business students who had no exposure to cases. The facts are that the mere act of listening to lectures and sound advice about managing does little for anyone's management skills and that the accumulated manage- rial wisdom cannot effectively be passed on by lectures and assigned readings alone. If anything had been learned about the practice of management, it is that a storehouse of ready-made textbook answers does not exist. Each managerial situation has unique aspects, requiring its own diagnosis, judgment, and tailor- made actions. Cases provide would-be managers with a valuable way to practice wrestling with the actual problems of actual managers in actual companies. The case approach to strategic analysis is, first and foremost, an exercise in learning by doing. Because cases provide you with detailed information about con- ditions and problems of different industries and com- panies, your task of analyzing company after company and situation after situation has the twin benefit of boosting your analytical skills and exposing you to the ways companies and managers actually do things. Most college students have limited managerial backgrounds and only fragmented knowledge about companies and real-life strategic situations. Cases help substitute on-the-job experience by (1) giving you broader exposure to a variety of industries, organizations, and strategic problems; (2) forcing you to assume a mana- gerial role (as opposed to that of just an onlooker); (3) providing a test of how to apply the tools and tech- niques of strategic management; and (4) asking you to come up with pragmatic managerial action plans to deal with the issues at hand. Objectives of Case Analysis Using cases to learn about the practice of strategic management is a powerful way for you to accomplish five things: 1. Increase your understanding of what managers should and should not do in guiding a business to success. 2. Build your skills in sizing up company resource strengths and weaknesses and in conducting stra- tegic analysis in a variety of industries and com- petitive situations. 3. Get valuable practice in identifying strategic issues that need to be addressed, evaluating strategic alter- natives, and formulating workable plans of action. 4. Enhance your sense of business judgment, as opposed to uncritically accepting the authorita- tive crutch of the professor or "back-of-the-book" answers. 5. Gaining in-depth exposure to different industries and companies, thereby acquiring something close to actual business experience. If you understand that these are the objectives of case analysis, you are less likely to be consumed with curiosity about "the answer to the case." Students who have grown comfortable with and accustomed to text- book statements of fact and definitive lecture notes are often frustrated when discussions about a case do not produce concrete answers. Usually, case dis- cussions produce good arguments for more than one course of action. Differences of opinion nearly always exist. Thus, should a class discussion conclude with- out a strong, unambiguous consensus on what to do, don't grumble too much when you are not told what the answer is or what the company actually did. Just remember that in the business world answers don't come in conclusive black-and-white terms. There are nearly always several feasible courses of action and approaches, each of which may work out satis- factorily. Moreover, in the business world, when one elects a particular course of action, there is no peek- ing at the back of a book to see if you have chosen the best thing to do and no one to turn to for a provably How Calculated What It Shows Ratio Profitability Ratios 1. Gross profit margin Sales - Cost of goods sold Sales Shows the percentage of revenues available to cover operating expenses and yield a profit. Higher is better and the trend should be upward. Shows the profitability of current operations without regard to interest charges and income taxes. Higher is better and the trend should be upward. 2. Operating profit margin (or return on sales) Sales - Operating expenses Sales or Operating income Sales Profits after taxes Sales Profits after taxes + Interest Total assets 3. Net profit margin (or net return on sales) 4. Total return on assets 5. Net return on total assets (ROA) Profits after taxes Total assets 6. Return on stockholder's equity (ROE) Profits after taxes Total stockholders' equity Shows after-tax profits per dollar of sales. Higher is better and the trend should be upward. A measure of the return on total monetary investment in the enterprise. Interest is added to after-tax profits to form the numerator since total assets are financed by creditors as well as by stockholders. Higher is better and the trend should be upward. A measure of the return earned by stockholders on the firm's total assets. Higher is better, and the trend should be upward. Shows the return stockholders are earning on their capital investment in the enterprise. A return in the 12-15% range is "average," and the trend should be upward. A measure of the return shareholders are earning on the long-term monetary capital invested in the enterprise. A higher return reflects greater bottom-line effectiveness in the use of long-term capital, and the trend should be upward. Shows the earnings for each share of common stock outstanding. The trend should be upward, and the bigger the annual percentage gains, the better. Profits after taxes Long-term debt + Total stockholders' equity 7. Return on invested capital (ROIC)- sometimes referred to as return on capital employed (ROCE) 8. Earnings per share (EPS) Profits after taxes Number of shares of common stock outstanding Liquidity Ratios 1. Current ratio 2. Working capital Current assets Shows a firm's ability to pay current liabilities using Current liabilities assets that can be converted to cash in the near term. Ratio should definitely be higher than 1.0; ratios of 2 or higher are better still. Current assets - Current liabilities Bigger amounts are better because the company has more internal funds available to (1) pay its current liabilities on a timely basis and (2) finance inventory expansion, additional accounts receivable, and a larger base of operations without resorting to borrowing or raising more equity capital. Leverage Ratios 1. Total debt-to-assets ratio Total debt Total assets Measures the extent to which borrowed funds have been used to finance the firm's operations. Low fractions or ratios are better-high fractions indicate overuse of debt and greater risk of bankruptcy. 2. Long-term debt-to- capital ratio Long-term debt Long-term debt + Total stockholders' equity An important measure of creditworthiness and balance sheet strength. Indicates the percentage of capital investment which has been financed by creditors and bondholders. Fractions or ratios below .25 or 25% are usually quite satisfactory since monies invested Leverage Ratios (Continued) 3. Debt-to-equity ratio Total debt Total stockholders' equity by stockholders account for 75% or more of the company's total capital. The lower the ratio, the greater the capacity to borrow additional funds. Debt-to capital ratios above 50% and certainly above 75% indicate a heavy and perhaps excessive reliance on debt, lower creditworthiness, and weak balance sheet strength. Should usually be less than 1.0. High ratios (especially above 1.0) signal excessive debt, lower creditworthiness, and weaker balance sheet strength. Shows the balance between debt and equity in the firm's long-term capital structure. Low ratios indicate greater capacity to borrow additional funds if needed. Measures the ability to pay annual interest charges. Lenders usually insist on a minimum ratio of 2.0, but ratios above 3.0 signal better creditworthiness. 4. Long-term debt-to- equity ratio Long-term debt Total stockholders' equity 4. Times-interest-earned (or coverage) ratio Operating income Interest expenses Activity Ratios 1. Days of inventory 2. Inventory turnover Inventory Cost of goods sold = 365 Cost of goods sold Inventory Accounts receivable Total sales revenues : 365 or Accounts receivable Average daily sales Measures inventory management efficiency. Fewer days of inventory are usually better. Measures the number of inventory turns per year. Higher is better. Indicates the average length of time the firm must wait after making a sale to receive cash payment. A shorter collection time is better. 3. Average collection period Other Important Measures of Financial Performance 1. Dividend yield on Annual dividends per share A measure of the return that shareholders receive in common stock Current market price per share the form of dividends. A "typical" dividend yield is 2-3%. The dividend yield for fast-growth companies is often below 1% (maybe even 0); the dividend yield for slow- growth companies can run 4-5%. 2. Price-earnings ratio Current market price per share P-e ratios above 20 indicate strong investor confidence Earnings per share in a firm's outlook and earnings growth; firms whose future earnings are at risk or likely to grow slowly typically have ratios below 12. 3. Dividend payout ratio Annual dividends per share Indicates the percentage of after-tax profits paid cut as Earnings per share dividends. 4. Internal cash flow After tax profits + Depreciation A quick and rough estimate of the c business is generating after payment of operating expenses, interest, and taxes. Such amounts can be used for dividend payments or funding capital expenditures. 5. Free cash flow After tax profits + Depreciation - A quick and rough estimate of the cash a company's Capital expenditures Dividends business is generating after payment of operating expenses, interest, taxes, dividends, and desirable reinvestments in the business. The larger a company's free cash flow, the greater is its ability to internally fund new strategic initiatives, repay debt, make new acquisitions, repurchase shares of stock, or increase dividend payments. than one good way to analyze a situation and more than one good plan of action. information provided. Many times cases report views and contradictory opinions (after all, people don't always agree on things, and different people see the same things in different ways). Forcing you to evaluate the data and information presented in the case helps you develop your powers of infer- ence and judgment. Asking you to resolve conflict- ing information comes with the territory because a great many managerial situations entail oppos- ing points of view, conflicting trends, and sketchy information. 8. Support your diagnosis and opinions with reasons and evidence. The most important things to pre- pare for are your answers to the question "Why?" For instance, if after studying the case you are of the opinion that the company's managers are doing a poor job, then it is your answer to Why?" that establishes just how good your analysis of the situ- ation is. If your instructor has provided you with specific study questions for the case, by all means prepare answers that include all the reasons and number-crunching evidence you can muster to support your diagnosis. If you are using study questions provided by the instructor, generate at least two pages of notes! 9. Develop an appropriate action plan and set of recommendations. Diagnosis divorced from correc- tive action is sterile. The test of a manager is always to convert sound analysis into sound actions- actions that will produce the desired results. Hence, the final and most telling step in preparing a case is to develop an action agenda for management that lays out a set of specific recommendations on what to do. Bear in mind that proposing realistic, work- able solutions is far preferable to casually tossing out off-the-top-of-your-head suggestions. Be prepared to argue why your recommendations are more attractive than other courses of action that are open. As long as you are conscientious in preparing your analysis and recommendations, and have ample reasons, evidence, and arguments to support your views, you shouldn't fret unduly about whether what you've prepared is "the right answer" to the case. In case analysis, there is rarely just one right approach or set of recommendations. Managing companies and crafting and executing strategies are not such exact sciences that there exists a single provably correct analysis and action plan for each strategic situation. Of course, some analyses and action plans are better than others; but, in truth, there's nearly always more Participating in Class Discussion of a Case Classroom discussions of cases are sharply different from attending a lecture class. In a case class, students do most of the talking. The instructor's role is to solicit student participation, keep the discussion on track, ask "Why?" often, offer alternative views, play the devil's advocate (if no students jump in to offer opposing views), and otherwise lead the discussion. The students in the class carry the burden for analyzing the situa- tion and for being prepared to present and defend their diagnoses and recommendations. Expect a classroom environment, therefore, that calls for your size-up of the situation, your analysis, what actions you would take, and why you would take them. Do not be dis- mayed if, as the class discussion unfolds, some insight- ful things are said by your fellow classmates that you did not think of. It is normal for views and analyses to differ and for the comments of others in the class to expand your own thinking about the case. As the old adage goes, Two heads are better than one." So it is to be expected that the class as a whole will do a more pen- etrating and searching job of case analysis than will any one person working alone. This is the power of group effort, and its virtues are that it will help you see more analytical applications, let you test your analyses and judgments against those of your peers, and force you to wrestle with differences of opinion and approaches. To orient you to the classroom environment on the days a case discussion is scheduled, we compiled the following list of things to expect 1. Expect the instructor to assume the role of exten- sive questioner and listener. 2. Expect students to do most of the talking. The case method enlists a maximum of individual participa- tion in class discussion. It is not enough to be pres- ent as a silent observer; if every student took this approach, there would be no discussion. (Thus, expect a portion of your grade to be based on your participation in case discussions.) 3. Be prepared for the instructor to probe for reasons and supporting analysis. 4. Expect and tolerate challenges to the views expressed. All students have to be willing to sub- mit their conclusions for scrutiny and rebuttal. Each student needs to learn to state his or her views extensively when you speak. There's no way you can remember everything off the top of your head- especially the results of your number crunching. To reel off the numbers or to present all five rea- sons why, instead of one, you will need good notes. When you have prepared thoughtful answers to the study questions and use them as the basis for your comments, everybody in the room will know you are well prepared, and your contribution to the case discussion will stand out. without fear of disapproval and to overcome the hesitation of speaking out. Learning respect for the views and approaches of others is an integral part of case analysis exercises. But there are times when it is OK to swim against the tide of majority opin- ion. In the practice of management, there is always room for originality and unorthodox approaches. So while discussion of a case is a group process, there is no compulsion for you or anyone else to cave in and conform to group opinions and group consensus. 5. Don't be surprised if you change your mind about some things as the discussion unfolds. Be alert to how these changes affect your analysis and recom- mendations in the event you get called on). 6. Expect to learn a lot in class as the discussion of a case progresses; furthermore, you will find that the build on one anotherwhat you learn in one case helps prepare you for the next case discussion. There are several things you can do on your own to be good and look good as a participant in class discussions: Although you should do your own indepen- dent work and independent thinking, don't hesitate before and after) class to discuss the case with other students. In real life, managers often discuss the com- pany's problems and situation with other people to refine their own thinking. . In participating in the discussion, make a conscious effort to contribute, rather than just talk. There is a big difference between saying something that builds the discussion and offering a long-winded, off-the-cuff remark that leaves the class wondering what the point was. Avoid the use of "I think," "I believe," and "I feel"; instead, say, "My analysis shows -" and "The com- pany should do_ because___"Always give supporting reasons and evidence for your views; then your instructor won't have to ask you "Why?" every time you make a comment. In making your points, assume that everyone has read the case and knows what it says. Avoid reciting and rehashing information in the case-instead, use the data and information to explain your assessment of the situation and to support your position. Bring the printouts of the work you've done on Case-Tutor or the notes you've prepared (usually two or three pages' worth) to class and rely on them Preparing a Written Case Analysis Preparing a written case analysis is much like pre- paring a case for class discussion, except that your analysis must be more complete and put in report form. Unfortunately, though, there is no ironclad procedure for doing a written case analysis. All we can offer are some general guidelines and words of wisdom-this is because company situations and management problems are so diverse that no one mechanical way to approach a written case assign- ment always works. Your instructor may assign you a specific topic around which to prepare your written report. Or, alternatively, you may be asked to do a comprehensive written case analysis, where the expectation is that you will (1) identify all the pertinent issues that manage- ment needs to address, (2) perform whatever analy- sis and evaluation is appropriate, and (3) propose an action plan and set of recommendations addressing the issues you have identified. In going through the exer- cise of identify, evaluate, and recommend, keep the following pointers in mind.' Identification It is essential early on in your paper that you provide a sharply focused diagnosis of strategic issues and key problems and that you dem- onstrate a good grasp of the company's present situ- ation. Make sure you can identify the firm's strategy (use the concepts and tools in Chapters 1-8 as diag- nostic aids) and that you can pinpoint whatever strat- egy implementation issues may exist (again, consult the material in Chapters 9-11 for diagnostic help). Consult the key points we have provided at the end of each chapter for further diagnostic suggestions. consider beginning your paper with an overview of the company's situation, its strategy, and the signifi- cant problems and issues that confront management. State problems/issues as clearly and precisely as you can. Unless it is necessary to do so for emphasis, avoid recounting facts and history about the company (assume your professor has read the case and is famil- iar with the organization). Analysis and Evaluation This is usually the hardest part of the report. Analysis is hard work! Check out the firm's financial ratios, its profit margins and rates of return, and its capital structure, and decide how strong the firm is financially. Table 1 contains a summary of various financial ratios and how they are calculated. Use it to assist in your financial diagnosis. Similarly, look at marketing, production, managerial competence, and other factors underlying the organi- zation's strategic successes and failures. Decide whether the firm has valuable resource strengths and compe- tencies and, if so, whether it is capitalizing on them. Check to see if the firm's strategy is producing satisfactory results and determine the reasons why or why not. Probe the nature and strength of the competitive forces confronting the company. Decide whether and why the firm's competitive position is getting stronger or weaker. Use the tools and concepts you have learned about to perform whatever analysis and evaluation is appropriate. Work through the case preparation exercise on Case-Tutor if one is available for the case you've been assigned. In writing your analysis and evaluation, bear in mind four things: 1. You are obliged to offer analysis and evidence to back up your conclusions. Do not rely on unsup- ported opinions, over-generalizations, and plati- tudes as a substitute for tight, logical argument backed up with facts and figures. 2. If your analysis involves some important quantita- tive calculations, use tables and charts to present the calculations clearly and efficiently. Don't just tack the exhibits on at the end of your report and let the reader figure out what they mean and why they were included. Instead, in the body of your report cite some of the key numbers, highlight the conclusions to be drawn from the exhibits, and refer the reader to your charts and exhibits for more details. 3. Demonstrate that you have command of the strate- gic concepts and analytical tools to which you have been exposed. Use them in your report. 4. Your interpretation of the evidence should be reasonable and objective. Be wary of preparing a one-sided argument that omits all aspects not favorable to your conclusions. Likewise, try not to exaggerate or overdramatize. Endeavor to inject balance into your analysis and to avoid emotional rhetoric. Strike phrases such as I think"I feel" and I believe when you edit your first draft and write in My analysis shows," instead. Recommendations The final section of the written case analysis should consist of a set of definite recommendations and a plan of action. Your set of recommendations should address all of the problems/ issues you identified and analyzed. If the recommenda- tions come as a surprise or do not follow logically from the analysis, the effect is to weaken greatly your sug- gestions of what to do. Obviously, your recommenda- tions for actions should offer a reasonable prospect of success. High-risk, bet-the-company recommendations should be made with caution. State how your recom- mendations will solve the problems you identified. Be sure the company is financially able to carry out what you recommend; also check to see if your recommen- dations are workable in terms of acceptance by the persons involved, the organization's competence to implement them, and prevailing market and environ- mental constraints. Try not to hedge or weasel on the actions you believe should be taken. By all means state your recommendations in suf- ficient detail to be meaningful-get down to some definite nitty-gritty specifics. Avoid such unhelpful statements as "the organization should do more plan- ning" or "the company should be more aggressive in marketing its product." For instance, if you determine that "the firm should improve its market position," then you need to set forth exactly how you think this should be done. Offer a definite agenda for action, stipulating a timetable and sequence for initiating actions, indicating priorities, and suggesting who should be responsible for doing what. In proposing an action plan, remember there is a great deal of difference between, on the one hand, being responsible for a decision that may be costly if it proves in error and, on the other hand, casually sug- gesting courses of action that might be taken when you do not have to bear the responsibility for any of the consequences. A good rule to follow in making your recommen- dations is: Avoid recommending anything you would not yourself be willing to do if you were in manage- ment's shoes. The importance of learning to develop good managerial judgment is indicated by the fact that, even though the same information and operating data may be available to every manager or executive in an organization, the quality of the judgments about what the information means and which actions need to be taken does vary from person to person.* It goes without saying that your report should be well organized and well written. Great ideas amount to little unless others can be convinced of their merit- this takes tight logic, the presentation of convincing evidence, and persuasively written arguments. you the latitude to structure your presentation how- ever you and your group members see fit. Regardless of the style preferred by your instructor, you should take great care in preparing for the pre- sentation. A good set of slides with good content and good visual appeal is essential to a first-rate presenta- tion. Take some care to choose a nice slide design, font size and style, and color scheme. We suggest including slides covering each of the following areas: An opening slide covering the "title" of the presen- tation and names of the presenters. A slide showing an outline of the presentation (perhaps with presenters' names by each topic). One or more slides showing the key problems and strategic issues that management needs to address. A series of slides covering your analysis of the com- pany's situation. A series of slides containing your recommenda- tions and the supporting arguments and reason- ing for each recommendation-one slide for each recommendation and the associated reasoning will give it a lot of merit. Preparing an Oral Presentation During the course of your business career it is very likely that you will be called upon to prepare and give a number of oral presentations. For this reason, it is com- mon in courses of this nature to assign cases for oral presentation to the whole class. Such assignments give you an opportunity to hone your presentation skills. The preparation of an oral presentation has much in common with that of a written case analysis. Both require identification of the strategic issues and prob- lems confronting the company, analysis of industry conditions and the company's situation, and the devel- opment of a thorough, well-thought out action plan. The substance of your analysis and quality of your recommendations in an oral presentation should be no different than in a written report. As with a writ- ten assignment, you'll need to demonstrate command of the relevant strategic concepts and tools of analysis and your recommendations should contain sufficient detail to provide clear direction for management. The main difference between an oral presentation and a written case is in the delivery format. Oral presenta- tions rely principally on verbalizing your diagnosis, analysis, and recommendations and visually enhanc- ing and supporting your oral discussion with colorful, snappy slides (usually created on Microsoft's Power- Point software) Typically, oral presentations involve group assign- ments. Your instructor will provide the details of the assignment-how work should be delegated among the group members and how the presentation should be conducted. Some instructors prefer that presen- tations begin with issue identification, followed by analysis of the industry and company situation anal- ysis, and conclude with a recommended action plan to improve company performance. Other instructors prefer that the presenters assume that the class has a good understanding of the external industry envi- ronment and the company's competitive position and expect the presentation to be strongly focused on the group's recommended action plan and supporting analysis and arguments. The latter approach requires cutting straight to the heart of the case and support- ing each recommendation with detailed analysis and persuasive reasoning. Still other instructors may give You and your team members should carefully plan and rehearse your slide show to maximize impact and minimize distractions. The slide show should include all of the pizzazz necessary to garner the attention of the audience, but not so much that it distracts from the content of what group members are saying to the class. You should remember that the role of slides is to help you communicate your points to the audience. Too many graphics, images, colors, and transitions may divert the audience's attention from what is being said or disrupt the flow of the presentation. Keep in mind that visually dazzling slides rarely hide a shallow or superficial or otherwise flawed case analysis from a perceptive audience. Most instructors will tell you that first-rate slides will definitely enhance a well-delivered presentation, but that impressive visual aids, if accom- panied by weak analysis and poor oral delivery, still add up to a substandard presentation. Researching Companies and Industries via the Internet and Online Data Services Very likely, there will be occasions when you need to get additional information about some of the assignee cases, perhaps because your instructor has asked you to do further research on the industry or company or because you are simply curious about what has happened to the company since the case was writ- ten. These days, it is relatively easy to run down recent industry developments and to find out whether a com- pany's strategic and financial situation has improved, deteriorated, or changed little since the conclusion of the case. The amount of information about companies and industries available on the Internet and through online data services is formidable and expanding rapidly. It is a fairly simple matter to go to company websites, click on the investor information offer- ings and press release files, and get quickly to use ful information. Most company websites allow you to view or print the company's quarterly and annual reports, its 10K and 100 filings with the Securities and Exchange Commission, and various company press releases of interest. Frequently, a company's website will also provide information about its mis- sion and vision statements, values statements, codes of ethics, and strategy information, as well as charts of the company's stock price. The company's recent press releases typically contain reliable information about what of interest has been going on-new prod- uct introductions, recent alliances and partnership agreements, recent acquisitions, summaries of the latest financial results, tidbits about the company's strategy, guidance about future revenues and earn- ings, and other late-breaking company develop- ments. Some company web pages also include links to the home pages of industry trade associations where you can find information about industry size, growth, recent industry news, statistical trends, and future outlook. Thus, an early step in researching a company on the Internet is always to go to its website and see what's available. Public and Subscription Websites with Good Information Plainly, you can use a search engine such as Google or Yahoo! or MSN to find the latest news on a company or articles written by report- ers that have appeared in the business media. These can be very valuable in running down information about recent company developments. However, keep in mind that the information retrieved by a search engine is "unfiltered and may include sources that are not reli- able or that contain inaccurate or misleading informa- tion. Be wary of information provided by authors who are unaffiliated with reputable organizations or publica- tions and articles that were published in off-beat sources or on websites with an agenda. Be especially careful in relying on the accuracy of information you find posted on various bulletin boards. Articles covering a com- pany or issue should be copyrighted or published by a reputable source. If you are turning in a paper contain- ing information gathered from the Internet, you should cite your sources (providing the Internet address and date visited); it is also wise to print web pages for your research file (some web pages are updated frequently). The Wall Street Journal, Bloomberg Businessweek, Forbes, Barron's, and Fortune are all good sources of articles on companies. The online edition of The Wall Street Journal contains the same information that is available daily in its print version of the paper, but the WSJ website also maintains a searchable database of all The Wall Street Journal articles published during the past few years. Fortune and Bloomberg Businessweek also make the content of the most current issue avail- able online to subscribers as well as provide archives sections that allow you to search for articles published during the past few years that may be related to a par- ticular keyword. The following publications and websites are particularly good sources of company and industry information: Online Data Services Lexis-Nexis, Bloom- berg Financial News Services, and other online subscription services available in many university libraries provide access to a wide array of business reference material. For example, the web-based Lexis- Nexis Academic Universe contains business news articles from general news sources, business publi- cations, and industry trade publications. Broadcast transcripts from financial news programs are also available through LexisNexis, as are full-text 10-Ks, 10-Qs, annual reports, and company profiles for more than 11,000 U.S. and international companies. Your business librarian should be able to direct you to the resources available through your library that will aid you in your research. Securities and Exchange Commission EDGAR database (contains company 10-ks, 10-Qs, etc.) http://www.sec.gov/edgar/searchedgar/ companysearch Google Finance http://finance.google.com CNN Money http://money.cnn.com Hoover's Online http://hoovers.com The Wall Street Journal Interactive Edition www.wsj.com Bloomberg Businessweek www.businessweek.com and www.bloomberg.com Fortune www.fortune.com MSN Money Central http://moneycentral.msn.com Yahoo! Finance http://finance.yahoo.com/ use a search engine, you will know where to go to look for the particular information that you want. Search engines nearly always turn up too many information sources that match your request rather than too few. The trick is to learn to zero in on those most relevant to what you are looking for. Like most things, once you get a little experience under your belt on how to do com- pany and industry research on the Internet, you will find that you can readily find the information you need. Some of these Internet sources require subscrip- ons in order to access their entire databases. You should/always explore the investor relations ection of every public company's website. In today's world, these websites typically have a wealth of infor- nation concerning a company's mission, core values, erformance targets, strategy, recent financial perfor- nance, and latest developments (as described in com- any press releases). Learning Comes Quickly With a modest vestment of time, you will learn how to use Internet ources and search engines to run down information n companies and industries quickly and efficiently. und it is a skill that will serve you well into the future. Once you become familiar with the data available at the Gifferent websites mentioned above and learn how to The Ten Commandments of Case Analysis As a way of summarizing our suggestions about how to approach the task of case analysis, we have we like to call "The Ten Commandments of Case Analysis." They are shown in Table 2. If you observe all or even most of these commandments faithfully as you prepare a case either for class discussion or for a written report, your chances of doing a good job on the assigned cases will be much improved. Hang in there, give it your best shot, and have some fun exploring what the real world of strategic management is all about. CABLE 2 The Ten Commandments of Case Analysis To be observed in written reports and oral presentations, and while participating in class discussions. 1. Go through the case twice, once for a quick overview and once to gain full command of the facts. Then take care to explore the information in every one of the case exhibits. 2. Make a complete list of the problems and issues that the company's management needs to address. 3. Be thorough in your analysis of the company's situation (make a minimum of one to two pages of notes detailing your diagnosis). 4. Look for opportunities to apply the concepts and analytical tools in the text chaptersall of the cases in the book have very definite ties to the material in one or more of the text chapters!!!! 5. Do enough number crunching to discover the story told by the data presented in the case. (To help you comply with this commandment, consult Table 1 in this section to guide your probing of a company's financial condition and financial performance.) 6. Support any and all off-the-cuff opinions with well-reasoned arguments and numerical evidence. Don't stop until you can purge "I think" and "I feel" from your assessment and, instead, are able to rely completely on "My analysis shows." 7. Prioritize your recommendations and make sure they can be carried out in an acceptable time frame with the available resources. 8. Support each recommendation with persuasive argument and reasons as to why it makes sense and should result in improved company performance. 9. Review your recommended action plan to see if it addresses all of the problems and issues you identified. Any set of recommendations that does not address all of the issues and problems you identified is incomplete and insufficient. 10. Avoid recommending any course of action that could have disastrous consequences if it doesn't work out as planned. Therefore be as alert to the downside risks of your recommendations as you are to their upside potential and appeal. n most courses in strategic management, students use cases about actual companies to practice stra- tegic analysis and to gain some experience in the tasks of crafting and implementing strategy. A case sets forth, in a factual manner, the events and orga- nizational circumstances surrounding a particular managerial situation. It puts readers at the scene of the action and familiarizes them with all the relevant cir- cumstances. A case on strategic management can con- cern a whole industry, a single organization, or some part of an organization; the organization involved can be either profit seeking or not-for-profit. The essence of the student's role in case analysis is to diagnose and size up the situation described in the case and then to recommend appropriate action steps. WHY USE CASES TO PRACTICE STRATEGIC MANAGEMENT? A student of business with tact Absorbed many answers he lacked. But acquiring a job, He said with a sob, "How does one fit answer to fact?" The foregoing limerick was used some years ago by Professor Charles Gragg to characterize the plight of business students who had no exposure to cases. The facts are that the mere act of listening to lectures and sound advice about managing does little for anyone's management skills and that the accumulated manage- rial wisdom cannot effectively be passed on by lectures and assigned readings alone. If anything had been learned about the practice of management, it is that a storehouse of ready-made textbook answers does not exist. Each managerial situation has unique aspects, requiring its own diagnosis, judgment, and tailor- made actions. Cases provide would-be managers with a valuable way to practice wrestling with the actual problems of actual managers in actual companies. The case approach to strategic analysis is, first and foremost, an exercise in learning by doing. Because cases provide you with detailed information about con- ditions and problems of different industries and com- panies, your task of analyzing company after company and situation after situation has the twin benefit of boosting your analytical skills and exposing you to the ways companies and managers actually do things. Most college students have limited managerial backgrounds and only fragmented knowledge about companies and real-life strategic situations. Cases help substitute on-the-job experience by (1) giving you broader exposure to a variety of industries, organizations, and strategic problems; (2) forcing you to assume a mana- gerial role (as opposed to that of just an onlooker); (3) providing a test of how to apply the tools and tech- niques of strategic management; and (4) asking you to come up with pragmatic managerial action plans to deal with the issues at hand. Objectives of Case Analysis Using cases to learn about the practice of strategic management is a powerful way for you to accomplish five things: 1. Increase your understanding of what managers should and should not do in guiding a business to success. 2. Build your skills in sizing up company resource strengths and weaknesses and in conducting stra- tegic analysis in a variety of industries and com- petitive situations. 3. Get valuable practice in identifying strategic issues that need to be addressed, evaluating strategic alter- natives, and formulating workable plans of action. 4. Enhance your sense of business judgment, as opposed to uncritically accepting the authorita- tive crutch of the professor or "back-of-the-book" answers. 5. Gaining in-depth exposure to different industries and companies, thereby acquiring something close to actual business experience. If you understand that these are the objectives of case analysis, you are less likely to be consumed with curiosity about "the answer to the case." Students who have grown comfortable with and accustomed to text- book statements of fact and definitive lecture notes are often frustrated when discussions about a case do not produce concrete answers. Usually, case dis- cussions produce good arguments for more than one course of action. Differences of opinion nearly always exist. Thus, should a class discussion conclude with- out a strong, unambiguous consensus on what to do, don't grumble too much when you are not told what the answer is or what the company actually did. Just remember that in the business world answers don't come in conclusive black-and-white terms. There are nearly always several feasible courses of action and approaches, each of which may work out satis- factorily. Moreover, in the business world, when one elects a particular course of action, there is no peek- ing at the back of a book to see if you have chosen the best thing to do and no one to turn to for a provably How Calculated What It Shows Ratio Profitability Ratios 1. Gross profit margin Sales - Cost of goods sold Sales Shows the percentage of revenues available to cover operating expenses and yield a profit. Higher is better and the trend should be upward. Shows the profitability of current operations without regard to interest charges and income taxes. Higher is better and the trend should be upward. 2. Operating profit margin (or return on sales) Sales - Operating expenses Sales or Operating income Sales Profits after taxes Sales Profits after taxes + Interest Total assets 3. Net profit margin (or net return on sales) 4. Total return on assets 5. Net return on total assets (ROA) Profits after taxes Total assets 6. Return on stockholder's equity (ROE) Profits after taxes Total stockholders' equity Shows after-tax profits per dollar of sales. Higher is better and the trend should be upward. A measure of the return on total monetary investment in the enterprise. Interest is added to after-tax profits to form the numerator since total assets are financed by creditors as well as by stockholders. Higher is better and the trend should be upward. A measure of the return earned by stockholders on the firm's total assets. Higher is better, and the trend should be upward. Shows the return stockholders are earning on their capital investment in the enterprise. A return in the 12-15% range is "average," and the trend should be upward. A measure of the return shareholders are earning on the long-term monetary capital invested in the enterprise. A higher return reflects greater bottom-line effectiveness in the use of long-term capital, and the trend should be upward. Shows the earnings for each share of common stock outstanding. The trend should be upward, and the bigger the annual percentage gains, the better. Profits after taxes Long-term debt + Total stockholders' equity 7. Return on invested capital (ROIC)- sometimes referred to as return on capital employed (ROCE) 8. Earnings per share (EPS) Profits after taxes Number of shares of common stock outstanding Liquidity Ratios 1. Current ratio 2. Working capital Current assets Shows a firm's ability to pay current liabilities using Current liabilities assets that can be converted to cash in the near term. Ratio should definitely be higher than 1.0; ratios of 2 or higher are better still. Current assets - Current liabilities Bigger amounts are better because the company has more internal funds available to (1) pay its current liabilities on a timely basis and (2) finance inventory expansion, additional accounts receivable, and a larger base of operations without resorting to borrowing or raising more equity capital. Leverage Ratios 1. Total debt-to-assets ratio Total debt Total assets Measures the extent to which borrowed funds have been used to finance the firm's operations. Low fractions or ratios are better-high fractions indicate overuse of debt and greater risk of bankruptcy. 2. Long-term debt-to- capital ratio Long-term debt Long-term debt + Total stockholders' equity An important measure of creditworthiness and balance sheet strength. Indicates the percentage of capital investment which has been financed by creditors and bondholders. Fractions or ratios below .25 or 25% are usually quite satisfactory since monies invested Leverage Ratios (Continued) 3. Debt-to-equity ratio Total debt Total stockholders' equity by stockholders account for 75% or more of the company's total capital. The lower the ratio, the greater the capacity to borrow additional funds. Debt-to capital ratios above 50% and certainly above 75% indicate a heavy and perhaps excessive reliance on debt, lower creditworthiness, and weak balance sheet strength. Should usually be less than 1.0. High ratios (especially above 1.0) signal excessive debt, lower creditworthiness, and weaker balance sheet strength. Shows the balance between debt and equity in the firm's long-term capital structure. Low ratios indicate greater capacity to borrow additional funds if needed. Measures the ability to pay annual interest charges. Lenders usually insist on a minimum ratio of 2.0, but ratios above 3.0 signal better creditworthiness. 4. Long-term debt-to- equity ratio Long-term debt Total stockholders' equity 4. Times-interest-earned (or coverage) ratio Operating income Interest expenses Activity Ratios 1. Days of inventory 2. Inventory turnover Inventory Cost of goods sold = 365 Cost of goods sold Inventory Accounts receivable Total sales revenues : 365 or Accounts receivable Average daily sales Measures inventory management efficiency. Fewer days of inventory are usually better. Measures the number of inventory turns per year. Higher is better. Indicates the average length of time the firm must wait after making a sale to receive cash payment. A shorter collection time is better. 3. Average collection period Other Important Measures of Financial Performance 1. Dividend yield on Annual dividends per share A measure of the return that shareholders receive in common stock Current market price per share the form of dividends. A "typical" dividend yield is 2-3%. The dividend yield for fast-growth companies is often below 1% (maybe even 0); the dividend yield for slow- growth companies can run 4-5%. 2. Price-earnings ratio Current market price per share P-e ratios above 20 indicate strong investor confidence Earnings per share in a firm's outlook and earnings growth; firms whose future earnings are at risk or likely to grow slowly typically have ratios below 12. 3. Dividend payout ratio Annual dividends per share Indicates the percentage of after-tax profits paid cut as Earnings per share dividends. 4. Internal cash flow After tax profits + Depreciation A quick and rough estimate of the c business is generating after payment of operating expenses, interest, and taxes. Such amounts can be used for dividend payments or funding capital expenditures. 5. Free cash flow After tax profits + Depreciation - A quick and rough estimate of the cash a company's Capital expenditures Dividends business is generating after payment of operating expenses, interest, taxes, dividends, and desirable reinvestments in the business. The larger a company's free cash flow, the greater is its ability to internally fund new strategic initiatives, repay debt, make new acquisitions, repurchase shares of stock, or increase dividend payments. than one good way to analyze a situation and more than one good plan of action. information provided. Many times cases report views and contradictory opinions (after all, people don't always agree on things, and different people see the same things in different ways). Forcing you to evaluate the data and information presented in the case helps you develop your powers of infer- ence and judgment. Asking you to resolve conflict- ing information comes with the territory because a great many managerial situations entail oppos- ing points of view, conflicting trends, and sketchy information. 8. Support your diagnosis and opinions with reasons and evidence. The most important things to pre- pare for are your answers to the question "Why?" For instance, if after studying the case you are of the opinion that the company's managers are doing a poor job, then it is your answer to Why?" that establishes just how good your analysis of the situ- ation is. If your instructor has provided you with specific study questions for the case, by all means prepare answers that include all the reasons and number-crunching evidence you can muster to support your diagnosis. If you are using study questions provided by the instructor, generate at least two pages of notes! 9. Develop an appropriate action plan and set of recommendations. Diagnosis divorced from correc- tive action is sterile. The test of a manager is always to convert sound analysis into sound actions- actions that will produce the desired results. Hence, the final and most telling step in preparing a case is to develop an action agenda for management that lays out a set of specific recommendations on what to do. Bear in mind that proposing realistic, work- able solutions is far preferable to casually tossing out off-the-top-of-your-head suggestions. Be prepared to argue why your recommendations are more attractive than other courses of action that are open. As long as you are conscientious in preparing your analysis and recommendations, and have ample reasons, evidence, and arguments to support your views, you shouldn't fret unduly about whether what you've prepared is "the right answer" to the case. In case analysis, there is rarely just one right approach or set of recommendations. Managing companies and crafting and executing strategies are not such exact sciences that there exists a single provably correct analysis and action plan for each strategic situation. Of course, some analyses and action plans are better than others; but, in truth, there's nearly always more Participating in Class Discussion of a Case Classroom discussions of cases are sharply different from attending a lecture class. In a case class, students do most of the talking. The instructor's role is to solicit student participation, keep the discussion on track, ask "Why?" often, offer alternative views, play the devil's advocate (if no students jump in to offer opposing views), and otherwise lead the discussion. The students in the class carry the burden for analyzing the situa- tion and for being prepared to present and defend their diagnoses and recommendations. Expect a classroom environment, therefore, that calls for your size-up of the situation, your analysis, what actions you would take, and why you would take them. Do not be dis- mayed if, as the class discussion unfolds, some insight- ful things are said by your fellow classmates that you did not think of. It is normal for views and analyses to differ and for the comments of others in the class to expand your own thinking about the case. As the old adage goes, Two heads are better than one." So it is to be expected that the class as a whole will do a more pen- etrating and searching job of case analysis than will any one person working alone. This is the power of group effort, and its virtues are that it will help you see more analytical applications, let you test your analyses and judgments against those of your peers, and force you to wrestle with differences of opinion and approaches. To orient you to the classroom environment on the days a case discussion is scheduled, we compiled the following list of things to expect 1. Expect the instructor to assume the role of exten- sive questioner and listener. 2. Expect students to do most of the talking. The case method enlists a maximum of individual participa- tion in class discussion. It is not enough to be pres- ent as a silent observer; if every student took this approach, there would be no discussion. (Thus, expect a portion of your grade to be based on your participation in case discussions.) 3. Be prepared for the instructor to probe for reasons and supporting analysis. 4. Expect and tolerate challenges to the views expressed. All students have to be willing to sub- mit their conclusions for scrutiny and rebuttal. Each student needs to learn to state his or her views extensively when you speak. There's no way you can remember everything off the top of your head- especially the results of your number crunching. To reel off the numbers or to present all five rea- sons why, instead of one, you will need good notes. When you have prepared thoughtful answers to the study questions and use them as the basis for your comments, everybody in the room will know you are well prepared, and your contribution to the case discussion will stand out. without fear of disapproval and to overcome the hesitation of speaking out. Learning respect for the views and approaches of others is an integral part of case analysis exercises. But there are times when it is OK to swim against the tide of majority opin- ion. In the practice of management, there is always room for originality and unorthodox approaches. So while discussion of a case is a group process, there is no compulsion for you or anyone else to cave in and conform to group opinions and group consensus. 5. Don't be surprised if you change your mind about some things as the discussion unfolds. Be alert to how these changes affect your analysis and recom- mendations in the event you get called on). 6. Expect to learn a lot in class as the discussion of a case progresses; furthermore, you will find that the build on one anotherwhat you learn in one case helps prepare you for the next case discussion. There are several things you can do on your own to be good and look good as a participant in class discussions: Although you should do your own indepen- dent work and independent thinking, don't hesitate before and after) class to discuss the case with other students. In real life, managers often discuss the com- pany's problems and situation with other people to refine their own thinking. . In participating in the discussion, make a conscious effort to contribute, rather than just talk. There is a big difference between saying something that builds the discussion and offering a long-winded, off-the-cuff remark that leaves the class wondering what the point was. Avoid the use of "I think," "I believe," and "I feel"; instead, say, "My analysis shows -" and "The com- pany should do_ because___"Always give supporting reasons and evidence for your views; then your instructor won't have to ask you "Why?" every time you make a comment. In making your points, assume that everyone has read the case and knows what it says. Avoid reciting and rehashing information in the case-instead, use the data and information to explain your assessment of the situation and to support your position. Bring the printouts of the work you've done on Case-Tutor or the notes you've prepared (usually two or three pages' worth) to class and rely on them Preparing a Written Case Analysis Preparing a written case analysis is much like pre- paring a case for class discussion, except that your analysis must be more complete and put in report form. Unfortunately, though, there is no ironclad procedure for doing a written case analysis. All we can offer are some general guidelines and words of wisdom-this is because company situations and management problems are so diverse that no one mechanical way to approach a written case assign- ment always works. Your instructor may assign you a specific topic around which to prepare your written report. Or, alternatively, you may be asked to do a comprehensive written case analysis, where the expectation is that you will (1) identify all the pertinent issues that manage- ment needs to address, (2) perform whatever analy- sis and evaluation is appropriate, and (3) propose an action plan and set of recommendations addressing the issues you have identified. In going through the exer- cise of identify, evaluate, and recommend, keep the following pointers in mind.' Identification It is essential early on in your paper that you provide a sharply focused diagnosis of strategic issues and key problems and that you dem- onstrate a good grasp of the company's present situ- ation. Make sure you can identify the firm's strategy (use the concepts and tools in Chapters 1-8 as diag- nostic aids) and that you can pinpoint whatever strat- egy implementation issues may exist (again, consult the material in Chapters 9-11 for diagnostic help). Consult the key points we have provided at the end of each chapter for further diagnostic suggestions. consider beginning your paper with an overview of the company's situation, its strategy, and the signifi- cant problems and issues that confront management. State problems/issues as clearly and precisely as you can. Unless it is necessary to do so for emphasis, avoid recounting facts and history about the company (assume your professor has read the case and is famil- iar with the organization). Analysis and Evaluation This is usually the hardest part of the report. Analysis is hard work! Check out the firm's financial ratios, its profit margins and rates of return, and its capital structure, and decide how strong the firm is financially. Table 1 contains a summary of various financial ratios and how they are calculated. Use it to assist in your financial diagnosis. Similarly, look at marketing, production, managerial competence, and other factors underlying the organi- zation's strategic successes and failures. Decide whether the firm has valuable resource strengths and compe- tencies and, if so, whether it is capitalizing on them. Check to see if the firm's strategy is producing satisfactory results and determine the reasons why or why not. Probe the nature and strength of the competitive forces confronting the company. Decide whether and why the firm's competitive position is getting stronger or weaker. Use the tools and concepts you have learned about to perform whatever analysis and evaluation is appropriate. Work through the case preparation exercise on Case-Tutor if one is available for the case you've been assigned. In writing your analysis and evaluation, bear in mind four things: 1. You are obliged to offer analysis and evidence to back up your conclusions. Do not rely on unsup- ported opinions, over-generalizations, and plati- tudes as a substitute for tight, logical argument backed up with facts and figures. 2. If your analysis involves some important quantita- tive calculations, use tables and charts to present the calculations clearly and efficiently. Don't just tack the exhibits on at the end of your report and let the reader figure out what they mean and why they were included. Instead, in the body of your report cite some of the key numbers, highlight the conclusions to be drawn from the exhibits, and refer the reader to your charts and exhibits for more details. 3. Demonstrate that you have command of the strate- gic concepts and analytical tools to which you have been exposed. Use them in your report. 4. Your interpretation of the evidence should be reasonable and objective. Be wary of preparing a one-sided argument that omits all aspects not favorable to your conclusions. Likewise, try not to exaggerate or overdramatize. Endeavor to inject balance into your analysis and to avoid emotional rhetoric. Strike phrases such as I think"I feel" and I believe when you edit your first draft and write in My analysis shows," instead. Recommendations The final section of the written case analysis should consist of a set of definite recommendations and a plan of action. Your set of recommendations should address all of the problems/ issues you identified and analyzed. If the recommenda- tions come as a surprise or do not follow logically from the analysis, the effect is to weaken greatly your sug- gestions of what to do. Obviously, your recommenda- tions for actions should offer a reasonable prospect of success. High-risk, bet-the-company recommendations should be made with caution. State how your recom- mendations will solve the problems you identified. Be sure the company is financially aGet Answers to Unlimited Questions

Join us to gain access to millions of questions and expert answers. Enjoy exclusive benefits tailored just for you!

Membership Benefits:

- Unlimited Question Access with detailed Answers

- Zin AI - 3 Million Words

- 10 Dall-E 3 Images

- 20 Plot Generations

- Conversation with Dialogue Memory

- No Ads, Ever!

- Access to Our Best AI Platform: Zin AI - Your personal assistant for all your inquiries!

Other questions asked by students

Mechanical Engineering

Accounting

Basic Math

Calculus

Accounting

Accounting

Accounting

StudyZin's Question Purchase

1 Answer

$0.99

(Save $1 )

One time Pay

- No Ads

- Answer to 1 Question

- Get free Zin AI - 50 Thousand Words per Month

Best

Unlimited

$4.99*

(Save $5 )

Billed Monthly

- No Ads

- Answers to Unlimited Questions

- Get free Zin AI - 3 Million Words per Month

*First month only

Free

$0

- Get this answer for free!

- Sign up now to unlock the answer instantly

You can see the logs in the Dashboard.