Hrubec Products, Incorporated, operates a Pulp Division that manufactures wood pulp for use in the...

90.2K

Verified Solution

Question

Accounting

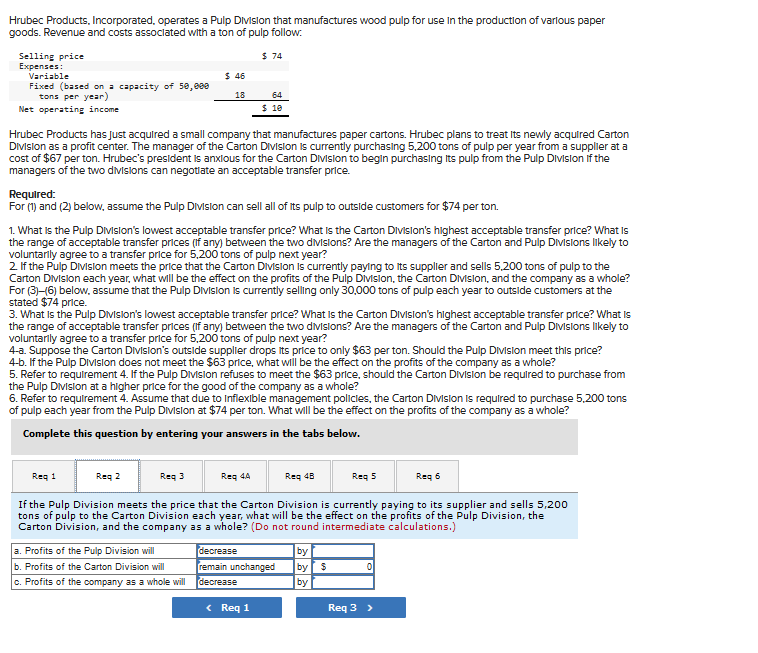

Hrubec Products, Incorporated, operates a Pulp Division that manufactures wood pulp for use in the productlon of varlous paper goods. Revenue and costs assoclated with a ton of pulp follow. Hrubec Products has just acquired a small company that manufactures paper cartons. Hrubec plans to treat Its newly acquired Carton Division as a profit center. The manager of the Carton Division is currently purchasing 5,200 tons of pulp per year from a supplier at a cost of $67 per ton. Hrubec's president is anxious for the Carton Division to begin purchasing its pulp from the Pulp Division if the managers of the two divisions can negotlate an acceptable transfer price. Required: For (1) and (2) below, assume the Pulp Division can sell all of its pulp to outside customers for $74 per ton. 1. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divlsions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 2. If the Pulp Division meets the price that the Carton Division is currently paying to its supplier and sells 5,200 tons of pulp to the Carton Division each year, what will be the effect on the profits of the Pulp Division, the Carton Division, and the company as a whole? For (3)-16) below, assume that the Pulp Division is currently selling only 30,000 tons of pulp each year to outside customers at the stated $74 price. 3. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 4-a. Suppose the Carton Division's outside supplier drops its price to only $63 per ton. Should the Pulp Division meet this price? 4-b. If the Pulp Division does not meet the $63 price, what will be the effect on the profits of the company as a whole? 5. Refer to requirement 4 . If the Pulp Divislon refuses to meet the $63 price, should the Carton Division be required to purchase from the Pulp Division at a higher price for the good of the company as a whole? 6. Refer to requirement 4. Assume that due to Inflexible management policles, the Carton Division is required to purchase 5,200 tons of pulp each year from the Pulp Division at $74 per ton. What will be the effect on the profits of the company as a whole? Complete this question by entering your answers in the tabs below. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (if any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarily agree to a transfer price for 5,200 tons of pulp next year? Hrubec Products, Incorporated, operates a Pulp Division that manufactures wood pulp for use in the productlon of various paper goods. Revenue and costs assoclated with a ton of pulp follow. Hrubec Products has just acquired a small company that manufactures paper cartons. Hrubec plans to treat its newly acquired Carton Division as a profit center. The manager of the Carton Division is currently purchasing 5,200 tons of pulp per year from a supplier at a cost of $67 per ton. Hrubec's president is anxious for the Carton Division to begin purchasing its pulp from the Pulp Division If the managers of the two divisions can negotlate an acceptable transfer price. Required: For (1) and (2) below, assume the Pulp Division can sell all of its pulp to outside customers for $74 per ton. 1. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (if any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 2 If the Pulp Division meets the price that the Carton Division is currently paying to its supplier and sells 5,200 tons of pulp to the Carton Division each year, what will be the effect on the profits of the Pulp Division, the Carton Division, and the company as a whole? For (3)-(6) below, assume that the Pulp Division is currently selling only 30,000 tons of pulp each year to outside customers at the stated $74 price. 3. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 4-a. Suppose the Carton Division's outside supplier drops its price to only $63 per ton. Should the Pulp Division meet this price? 4-b. If the Pulp Division does not meet the $63 price, what will be the effect on the profits of the company as a whole? 5. Refer to requirement 4. If the Pulp Division refuses to meet the $63 price, should the Carton Division be requlred to purchase from the Pulp Division at a higher price for the good of the company as a whole? 6. Refer to requirement 4. Assume that due to Inflexible management policles, the Carton Division is required to purchase 5,200 tons of pulp each year from the Pulp Division at $74 per ton. What will be the effect on the profits of the company as a whole? Complete this question by entering your answers in the tabs below. If the Pulp Division meets the price that the Carton Division is currently paying to its supplier and sells 5,200 tons of pulp to the Carton Division each year, what will be the effect on the profits of the Pulp Division, the Carton Division, and the company as a whole? (Do not round intermediate calculations.) Hrubec Products, Incorporated, operates a Pulp Division that manufactures wood pulp for use in the production of various paper goods. Revenue and costs assoclated with a ton of pulp follow. Hrubec Products has just acquired a small company that manufactures paper cartons. Hrubec plans to treat Its newly acquired Carton Division as a profit center. The manager of the Carton Division is currently purchasing 5,200 tons of pulp per year from a supplier at a cost of $67 per ton. Hrubec's president is anxious for the Carton Division to begin purchasing its pulp from the Pulp Division If the managers of the two divisions can negotlate an acceptable transfer price. Required: For (1) and (2) below, assume the Pulp Division can sell all of its pulp to outside customers for $74 per ton. 1. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 2 If the Pulp Division meets the price that the Carton Division is currently paying to its supplier and sells 5,200 tons of pulp to the Carton Division each year, what will be the effect on the profits of the Pulp Divislon, the Carton Division, and the company as a whole? For (3)-(6) below, assume that the Pulp Division is currently selling only 30,000 tons of pulp each year to outside customers at the stated $74 price. 3. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 4-a. Suppose the Carton Division's outside supplier drops its price to only $63 per ton. Should the Pulp Division meet this price? 4-b. If the Pulp Division does not meet the $63 price, what will be the effect on the profits of the company as a whole? 5. Refer to requirement 4 . If the Pulp Division refuses to meet the $63 price, should the Carton Division be required to purchase from the Pulp Division at a higher price for the good of the company as a whole? 6. Refer to requirement 4. Assume that due to Inflexible management policles, the Carton Division is required to purchase 5,200 tons of pulp each year from the Pulp Division at $74 per ton. What will be the effect on the profits of the company as a whole? Complete this question by entering your answers in the tabs below. What is the Pulp Division's 1 Req 3 cceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the ra Req 3 acceptable transfer prices (if any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarily agree to a transfer price for 5,200 tons of pulp next year? (Round your answers to nearest whole dollar amount.) Hrubec Products, Incorporated, operates a Pulp Division that manufactures wood pulp for use in the productlon of various paper goods. Revenue and costs assoclated with a ton of pulp follow. Hrubec Products has just acquired a small company that manufactures paper cartons. Hrubec plans to treat Its newly acquired Carton Division as a profit center. The manager of the Carton Division is currently purchasing 5,200 tons of pulp per year from a supplier at a cost of $67 per ton. Hrubec's president is anxious for the Carton Division to begin purchasing its pulp from the Pulp Division if the managers of the two divisions can negotlate an acceptable transfer price. Required: For (1) and (2) below, assume the Pulp Division can sell all of its pulp to outside customers for $74 per ton. 1. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 2 If the Pulp Division meets the price that the Carton Division is currently paying to its supplier and sells 5,200 tons of pulp to the Carton Division each year, what will be the effect on the profits of the Pulp Divislon, the Carton Division, and the company as a whole? For (3)-16) below, assume that the Pulp Division is currently selling only 30,000 tons of pulp each year to outside customers at the stated $74 price. 3. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 4-a. Suppose the Carton Division's outside supplier drops its price to only $63 per ton. Should the Pulp Division meet this price? 4-b. If the Pulp Division does not meet the $63 price, what will be the effect on the profits of the company as a whole? 5. Refer to requirement 4 . If the Pulp Division refuses to meet the $63 price, should the Carton Division be required to purchase from the Pulp Division at a higher price for the good of the company as a whole? 6. Refer to requirement 4. Assume that due to Inflexible management policles, the Carton Division is required to purchase 5,200 tons of pulp each year from the Pulp Division at $74 per ton. What will be the effect on the profits of the company as a whole? Complete this question by entering your answers in the tabs below. Suppose the Carton Division's outside supplier drops its price to only $63 per ton. Should the Pulp Division meet this price? Hrubec Products, Incorporated, operates a Pulp Division that manufactures wood pulp for use in the productlon of various paper goods. Revenue and costs assoclated with a ton of pulp follow. Hrubec Products has Just acquired a small company that manufactures paper cartons. Hrubec plans to treat Its newly acquired Carton Division as a profit center. The manager of the Carton Division is currently purchasing 5,200 tons of pulp per year from a supplier at a cost of $67 per ton. Hrubec's president is anxious for the Carton Division to begin purchasing Its pulp from the Pulp Division if the managers of the two divisions can negotlate an acceptable transfer price. Required: For (1) and (2) below, assume the Pulp Division can sell all of its pulp to outside customers for $74 per ton. 1. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions Iikely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 2 If the Pulp Division meets the price that the Carton Division is currently paying to its supplier and sells 5,200 tons of pulp to the Carton Division each year, what will be the effect on the profits of the Pulp Divislon, the Carton DIvision, and the company as a whole? For (3)-(6) below, assume that the Pulp Division is currently selling only 30,000 tons of pulp each year to outside customers at the stated $74 price. 3. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 4-a. Suppose the Carton Division's outside supplier drops its price to only $63 per ton. Should the Pulp Division meet this price? 4-b. If the Pulp Division does not meet the $63 price, what will be the effect on the profits of the company as a whole? 5. Refer to requirement 4 . If the Pulp Divislon refuses to meet the $63 price, should the Carton Division be requlred to purchase from the Pulp Division at a higher price for the good of the company as a whole? 6. Refer to requirement 4. Assume that due to Inflexible management policles, the Carton Division is required to purchase 5,200 tons of pulp each year from the Pulp Division at $74 per ton. What will be the effect on the profits of the company as a whole? Complete this question by entering your answers in the tabs below. If the Pulp Division does not meet the $63 price, what will whole? fect on the profits of the company as a Hrubec Products, Incorporated, operates a Pulp DIvision that manufactures wood pulp for use in the production of varlous paper goods. Revenue and costs assoclated with a ton of pulp follow. Hrubec Products has just acquired a small company that manufactures paper cartons. Hrubec plans to treat its newly acqulred Carton Division as a profit center. The manager of the Carton Division is currently purchasing 5,200 tons of pulp per year from a supplier at a cost of $67 per ton. Hrubec's president is anxious for the Carton Division to begin purchasing its pulp from the Pulp Division if the managers of the two divisions can negotlate an acceptable transfer price. Required: For (1) and (2) below, assume the Pulp Division can sell all of its pulp to outside customers for $74 per ton. 1. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 2 If the Pulp Division meets the price that the Carton Division is currently paying to its supplier and sells 5,200 tons of pulp to the Carton Division each year, what will be the effect on the profits of the Pulp Division, the Carton Division, and the company as a whole? For (3) - (6) below, assume that the Pulp Division is currently selling only 30,000 tons of pulp each year to outside customers at the stated $74 price. 3. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions Ilkely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 4-a. Suppose the Carton Division's outside supplier drops its price to only $63 per ton. Should the Pulp Division meet this price? 4-b. If the Pulp Division does not meet the $63 price, what will be the effect on the profits of the company as a whole? 5. Refer to requirement 4 . If the Pulp Division refuses to meet the $63 price, should the Carton Division be required to purchase from the Pulp Division at a higher price for the good of the company as a whole? 6. Refer to requirement 4. Assume that due to Inflexible management policles, the Carton Division is required to purchase 5,200 tons of pulp each year from the Pulp Division at $74 per ton. What will be the effect on the profits of the company as a whole? Complete this question by entering your answers in the tabs below. Refer to requirement 4 . If the Pulp Division refuses to meet the $63 price, should the Carton Division be required to purchase from the Pulp Division at a higher price for the good of the company as a whole? Should the Carton Division be required to purchase from the Pulp Division Hrubec Products, Incorporated, operates a Pulp Division that manufactures wood pulp for use in the production of various paper goods. Revenue and costs assoclated with a ton of pulp follow: Hrubec Products has Just acquired a small company that manufactures paper cartons. Hrubec plans to treat Its newly acquired Carton Division as a profit center. The manager of the Carton Division is currently purchasing 5,200 tons of pulp per year from a supplier at a cost of $67 per ton. Hrubec's president is anxious for the Carton Division to begin purchasing its pulp from the Pulp Division if the managers of the two divisions can negotlate an acceptable transfer price. Required: For (1) and (2) below, assume the Pulp Division can sell all of its pulp to outside customers for $74 per ton. 1. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (if any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 2 If the Pulp Division meets the price that the Carton Division is currently paying to its supplier and sells 5,200 tons of pulp to the Carton Division each year, what will be the effect on the profits of the Pulp Division, the Carton Division, and the company as a whole? For (3) -(6) below, assume that the Pulp Division is currently selling only 30,000 tons of pulp each year to outside customers at the stated $74 price. 3. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 4-a. Suppose the Carton Division's outside supplier drops its price to only $63 per ton. Should the Pulp Division meet this price? 4-b. If the Pulp Division does not meet the $63 price, what will be the effect on the profits of the company as a whole? 5. Refer to requirement 4 . If the Pulp Division refuses to meet the $63 price, should the Carton Division be required to purchase from the Pulp Division at a higher price for the good of the company as a whole? 6. Refer to requirement 4. Assume that due to Inflexible management policles, the Carton Division is required to purchase 5,200 tons of pulp each year from the Pulp Division at $74 per ton. What will be the effect on the profits of the company as a whole? Complete this question by entering your answers in the tabs below. Refer to requirement 4. Assume that due to inflexible management policies, the Carton Division is required to purchase 5,200 tons of pulp each year from the Pulp Division at $74 per ton. What will be the effect on the profits of the company as a whole

Hrubec Products, Incorporated, operates a Pulp Division that manufactures wood pulp for use in the productlon of varlous paper goods. Revenue and costs assoclated with a ton of pulp follow. Hrubec Products has just acquired a small company that manufactures paper cartons. Hrubec plans to treat Its newly acquired Carton Division as a profit center. The manager of the Carton Division is currently purchasing 5,200 tons of pulp per year from a supplier at a cost of $67 per ton. Hrubec's president is anxious for the Carton Division to begin purchasing its pulp from the Pulp Division if the managers of the two divisions can negotlate an acceptable transfer price. Required: For (1) and (2) below, assume the Pulp Division can sell all of its pulp to outside customers for $74 per ton. 1. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divlsions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 2. If the Pulp Division meets the price that the Carton Division is currently paying to its supplier and sells 5,200 tons of pulp to the Carton Division each year, what will be the effect on the profits of the Pulp Division, the Carton Division, and the company as a whole? For (3)-16) below, assume that the Pulp Division is currently selling only 30,000 tons of pulp each year to outside customers at the stated $74 price. 3. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 4-a. Suppose the Carton Division's outside supplier drops its price to only $63 per ton. Should the Pulp Division meet this price? 4-b. If the Pulp Division does not meet the $63 price, what will be the effect on the profits of the company as a whole? 5. Refer to requirement 4 . If the Pulp Divislon refuses to meet the $63 price, should the Carton Division be required to purchase from the Pulp Division at a higher price for the good of the company as a whole? 6. Refer to requirement 4. Assume that due to Inflexible management policles, the Carton Division is required to purchase 5,200 tons of pulp each year from the Pulp Division at $74 per ton. What will be the effect on the profits of the company as a whole? Complete this question by entering your answers in the tabs below. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (if any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarily agree to a transfer price for 5,200 tons of pulp next year? Hrubec Products, Incorporated, operates a Pulp Division that manufactures wood pulp for use in the productlon of various paper goods. Revenue and costs assoclated with a ton of pulp follow. Hrubec Products has just acquired a small company that manufactures paper cartons. Hrubec plans to treat its newly acquired Carton Division as a profit center. The manager of the Carton Division is currently purchasing 5,200 tons of pulp per year from a supplier at a cost of $67 per ton. Hrubec's president is anxious for the Carton Division to begin purchasing its pulp from the Pulp Division If the managers of the two divisions can negotlate an acceptable transfer price. Required: For (1) and (2) below, assume the Pulp Division can sell all of its pulp to outside customers for $74 per ton. 1. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (if any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 2 If the Pulp Division meets the price that the Carton Division is currently paying to its supplier and sells 5,200 tons of pulp to the Carton Division each year, what will be the effect on the profits of the Pulp Division, the Carton Division, and the company as a whole? For (3)-(6) below, assume that the Pulp Division is currently selling only 30,000 tons of pulp each year to outside customers at the stated $74 price. 3. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 4-a. Suppose the Carton Division's outside supplier drops its price to only $63 per ton. Should the Pulp Division meet this price? 4-b. If the Pulp Division does not meet the $63 price, what will be the effect on the profits of the company as a whole? 5. Refer to requirement 4. If the Pulp Division refuses to meet the $63 price, should the Carton Division be requlred to purchase from the Pulp Division at a higher price for the good of the company as a whole? 6. Refer to requirement 4. Assume that due to Inflexible management policles, the Carton Division is required to purchase 5,200 tons of pulp each year from the Pulp Division at $74 per ton. What will be the effect on the profits of the company as a whole? Complete this question by entering your answers in the tabs below. If the Pulp Division meets the price that the Carton Division is currently paying to its supplier and sells 5,200 tons of pulp to the Carton Division each year, what will be the effect on the profits of the Pulp Division, the Carton Division, and the company as a whole? (Do not round intermediate calculations.) Hrubec Products, Incorporated, operates a Pulp Division that manufactures wood pulp for use in the production of various paper goods. Revenue and costs assoclated with a ton of pulp follow. Hrubec Products has just acquired a small company that manufactures paper cartons. Hrubec plans to treat Its newly acquired Carton Division as a profit center. The manager of the Carton Division is currently purchasing 5,200 tons of pulp per year from a supplier at a cost of $67 per ton. Hrubec's president is anxious for the Carton Division to begin purchasing its pulp from the Pulp Division If the managers of the two divisions can negotlate an acceptable transfer price. Required: For (1) and (2) below, assume the Pulp Division can sell all of its pulp to outside customers for $74 per ton. 1. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 2 If the Pulp Division meets the price that the Carton Division is currently paying to its supplier and sells 5,200 tons of pulp to the Carton Division each year, what will be the effect on the profits of the Pulp Divislon, the Carton Division, and the company as a whole? For (3)-(6) below, assume that the Pulp Division is currently selling only 30,000 tons of pulp each year to outside customers at the stated $74 price. 3. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 4-a. Suppose the Carton Division's outside supplier drops its price to only $63 per ton. Should the Pulp Division meet this price? 4-b. If the Pulp Division does not meet the $63 price, what will be the effect on the profits of the company as a whole? 5. Refer to requirement 4 . If the Pulp Division refuses to meet the $63 price, should the Carton Division be required to purchase from the Pulp Division at a higher price for the good of the company as a whole? 6. Refer to requirement 4. Assume that due to Inflexible management policles, the Carton Division is required to purchase 5,200 tons of pulp each year from the Pulp Division at $74 per ton. What will be the effect on the profits of the company as a whole? Complete this question by entering your answers in the tabs below. What is the Pulp Division's 1 Req 3 cceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the ra Req 3 acceptable transfer prices (if any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarily agree to a transfer price for 5,200 tons of pulp next year? (Round your answers to nearest whole dollar amount.) Hrubec Products, Incorporated, operates a Pulp Division that manufactures wood pulp for use in the productlon of various paper goods. Revenue and costs assoclated with a ton of pulp follow. Hrubec Products has just acquired a small company that manufactures paper cartons. Hrubec plans to treat Its newly acquired Carton Division as a profit center. The manager of the Carton Division is currently purchasing 5,200 tons of pulp per year from a supplier at a cost of $67 per ton. Hrubec's president is anxious for the Carton Division to begin purchasing its pulp from the Pulp Division if the managers of the two divisions can negotlate an acceptable transfer price. Required: For (1) and (2) below, assume the Pulp Division can sell all of its pulp to outside customers for $74 per ton. 1. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 2 If the Pulp Division meets the price that the Carton Division is currently paying to its supplier and sells 5,200 tons of pulp to the Carton Division each year, what will be the effect on the profits of the Pulp Divislon, the Carton Division, and the company as a whole? For (3)-16) below, assume that the Pulp Division is currently selling only 30,000 tons of pulp each year to outside customers at the stated $74 price. 3. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 4-a. Suppose the Carton Division's outside supplier drops its price to only $63 per ton. Should the Pulp Division meet this price? 4-b. If the Pulp Division does not meet the $63 price, what will be the effect on the profits of the company as a whole? 5. Refer to requirement 4 . If the Pulp Division refuses to meet the $63 price, should the Carton Division be required to purchase from the Pulp Division at a higher price for the good of the company as a whole? 6. Refer to requirement 4. Assume that due to Inflexible management policles, the Carton Division is required to purchase 5,200 tons of pulp each year from the Pulp Division at $74 per ton. What will be the effect on the profits of the company as a whole? Complete this question by entering your answers in the tabs below. Suppose the Carton Division's outside supplier drops its price to only $63 per ton. Should the Pulp Division meet this price? Hrubec Products, Incorporated, operates a Pulp Division that manufactures wood pulp for use in the productlon of various paper goods. Revenue and costs assoclated with a ton of pulp follow. Hrubec Products has Just acquired a small company that manufactures paper cartons. Hrubec plans to treat Its newly acquired Carton Division as a profit center. The manager of the Carton Division is currently purchasing 5,200 tons of pulp per year from a supplier at a cost of $67 per ton. Hrubec's president is anxious for the Carton Division to begin purchasing Its pulp from the Pulp Division if the managers of the two divisions can negotlate an acceptable transfer price. Required: For (1) and (2) below, assume the Pulp Division can sell all of its pulp to outside customers for $74 per ton. 1. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions Iikely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 2 If the Pulp Division meets the price that the Carton Division is currently paying to its supplier and sells 5,200 tons of pulp to the Carton Division each year, what will be the effect on the profits of the Pulp Divislon, the Carton DIvision, and the company as a whole? For (3)-(6) below, assume that the Pulp Division is currently selling only 30,000 tons of pulp each year to outside customers at the stated $74 price. 3. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 4-a. Suppose the Carton Division's outside supplier drops its price to only $63 per ton. Should the Pulp Division meet this price? 4-b. If the Pulp Division does not meet the $63 price, what will be the effect on the profits of the company as a whole? 5. Refer to requirement 4 . If the Pulp Divislon refuses to meet the $63 price, should the Carton Division be requlred to purchase from the Pulp Division at a higher price for the good of the company as a whole? 6. Refer to requirement 4. Assume that due to Inflexible management policles, the Carton Division is required to purchase 5,200 tons of pulp each year from the Pulp Division at $74 per ton. What will be the effect on the profits of the company as a whole? Complete this question by entering your answers in the tabs below. If the Pulp Division does not meet the $63 price, what will whole? fect on the profits of the company as a Hrubec Products, Incorporated, operates a Pulp DIvision that manufactures wood pulp for use in the production of varlous paper goods. Revenue and costs assoclated with a ton of pulp follow. Hrubec Products has just acquired a small company that manufactures paper cartons. Hrubec plans to treat its newly acqulred Carton Division as a profit center. The manager of the Carton Division is currently purchasing 5,200 tons of pulp per year from a supplier at a cost of $67 per ton. Hrubec's president is anxious for the Carton Division to begin purchasing its pulp from the Pulp Division if the managers of the two divisions can negotlate an acceptable transfer price. Required: For (1) and (2) below, assume the Pulp Division can sell all of its pulp to outside customers for $74 per ton. 1. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 2 If the Pulp Division meets the price that the Carton Division is currently paying to its supplier and sells 5,200 tons of pulp to the Carton Division each year, what will be the effect on the profits of the Pulp Division, the Carton Division, and the company as a whole? For (3) - (6) below, assume that the Pulp Division is currently selling only 30,000 tons of pulp each year to outside customers at the stated $74 price. 3. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions Ilkely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 4-a. Suppose the Carton Division's outside supplier drops its price to only $63 per ton. Should the Pulp Division meet this price? 4-b. If the Pulp Division does not meet the $63 price, what will be the effect on the profits of the company as a whole? 5. Refer to requirement 4 . If the Pulp Division refuses to meet the $63 price, should the Carton Division be required to purchase from the Pulp Division at a higher price for the good of the company as a whole? 6. Refer to requirement 4. Assume that due to Inflexible management policles, the Carton Division is required to purchase 5,200 tons of pulp each year from the Pulp Division at $74 per ton. What will be the effect on the profits of the company as a whole? Complete this question by entering your answers in the tabs below. Refer to requirement 4 . If the Pulp Division refuses to meet the $63 price, should the Carton Division be required to purchase from the Pulp Division at a higher price for the good of the company as a whole? Should the Carton Division be required to purchase from the Pulp Division Hrubec Products, Incorporated, operates a Pulp Division that manufactures wood pulp for use in the production of various paper goods. Revenue and costs assoclated with a ton of pulp follow: Hrubec Products has Just acquired a small company that manufactures paper cartons. Hrubec plans to treat Its newly acquired Carton Division as a profit center. The manager of the Carton Division is currently purchasing 5,200 tons of pulp per year from a supplier at a cost of $67 per ton. Hrubec's president is anxious for the Carton Division to begin purchasing its pulp from the Pulp Division if the managers of the two divisions can negotlate an acceptable transfer price. Required: For (1) and (2) below, assume the Pulp Division can sell all of its pulp to outside customers for $74 per ton. 1. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (if any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 2 If the Pulp Division meets the price that the Carton Division is currently paying to its supplier and sells 5,200 tons of pulp to the Carton Division each year, what will be the effect on the profits of the Pulp Division, the Carton Division, and the company as a whole? For (3) -(6) below, assume that the Pulp Division is currently selling only 30,000 tons of pulp each year to outside customers at the stated $74 price. 3. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (If any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarly agree to a transfer price for 5,200 tons of pulp next year? 4-a. Suppose the Carton Division's outside supplier drops its price to only $63 per ton. Should the Pulp Division meet this price? 4-b. If the Pulp Division does not meet the $63 price, what will be the effect on the profits of the company as a whole? 5. Refer to requirement 4 . If the Pulp Division refuses to meet the $63 price, should the Carton Division be required to purchase from the Pulp Division at a higher price for the good of the company as a whole? 6. Refer to requirement 4. Assume that due to Inflexible management policles, the Carton Division is required to purchase 5,200 tons of pulp each year from the Pulp Division at $74 per ton. What will be the effect on the profits of the company as a whole? Complete this question by entering your answers in the tabs below. Refer to requirement 4. Assume that due to inflexible management policies, the Carton Division is required to purchase 5,200 tons of pulp each year from the Pulp Division at $74 per ton. What will be the effect on the profits of the company as a whole

Get Answers to Unlimited Questions

Join us to gain access to millions of questions and expert answers. Enjoy exclusive benefits tailored just for you!

Membership Benefits:

- Unlimited Question Access with detailed Answers

- Zin AI - 3 Million Words

- 10 Dall-E 3 Images

- 20 Plot Generations

- Conversation with Dialogue Memory

- No Ads, Ever!

- Access to Our Best AI Platform: Zin AI - Your personal assistant for all your inquiries!

Other questions asked by students

Statistics

Advance Math

Basic Math

Basic Math

Q

Your answer is partially correct Moonbeam Company manufactures toasters For the first 8 months of...

Statistics

Q

5. (4 points) Dividend Allocation Durden Co. has $10 par value, 12% cumulative preferred stock....

Accounting

Accounting

Accounting

StudyZin's Question Purchase

1 Answer

$0.99

(Save $1 )

One time Pay

- No Ads

- Answer to 1 Question

- Get free Zin AI - 50 Thousand Words per Month

Best

Unlimited

$4.99*

(Save $5 )

Billed Monthly

- No Ads

- Answers to Unlimited Questions

- Get free Zin AI - 3 Million Words per Month

*First month only

Free

$0

- Get this answer for free!

- Sign up now to unlock the answer instantly

You can see the logs in the Dashboard.