Other questions asked by students

Q

Find the vector and parametric equations for the plane. The plane that contains the lines r1(t)...

Advance Math

Geometry

Statistics

Accounting

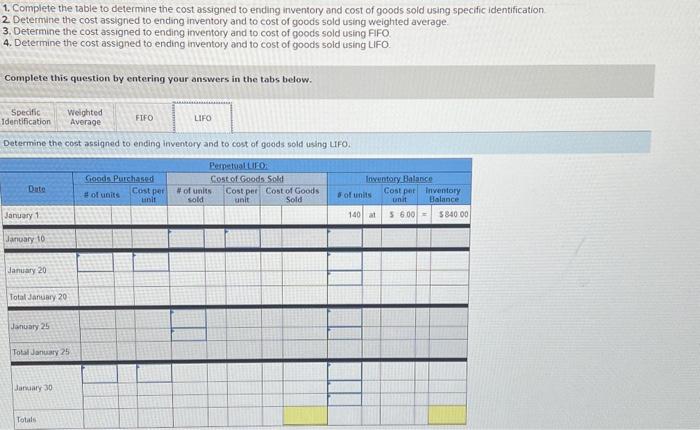

Accounting

Accounting