Other questions asked by students

Basic Math

Biology

Civil Engineering

Mechanical Engineering

Geometry

Algebra

Accounting

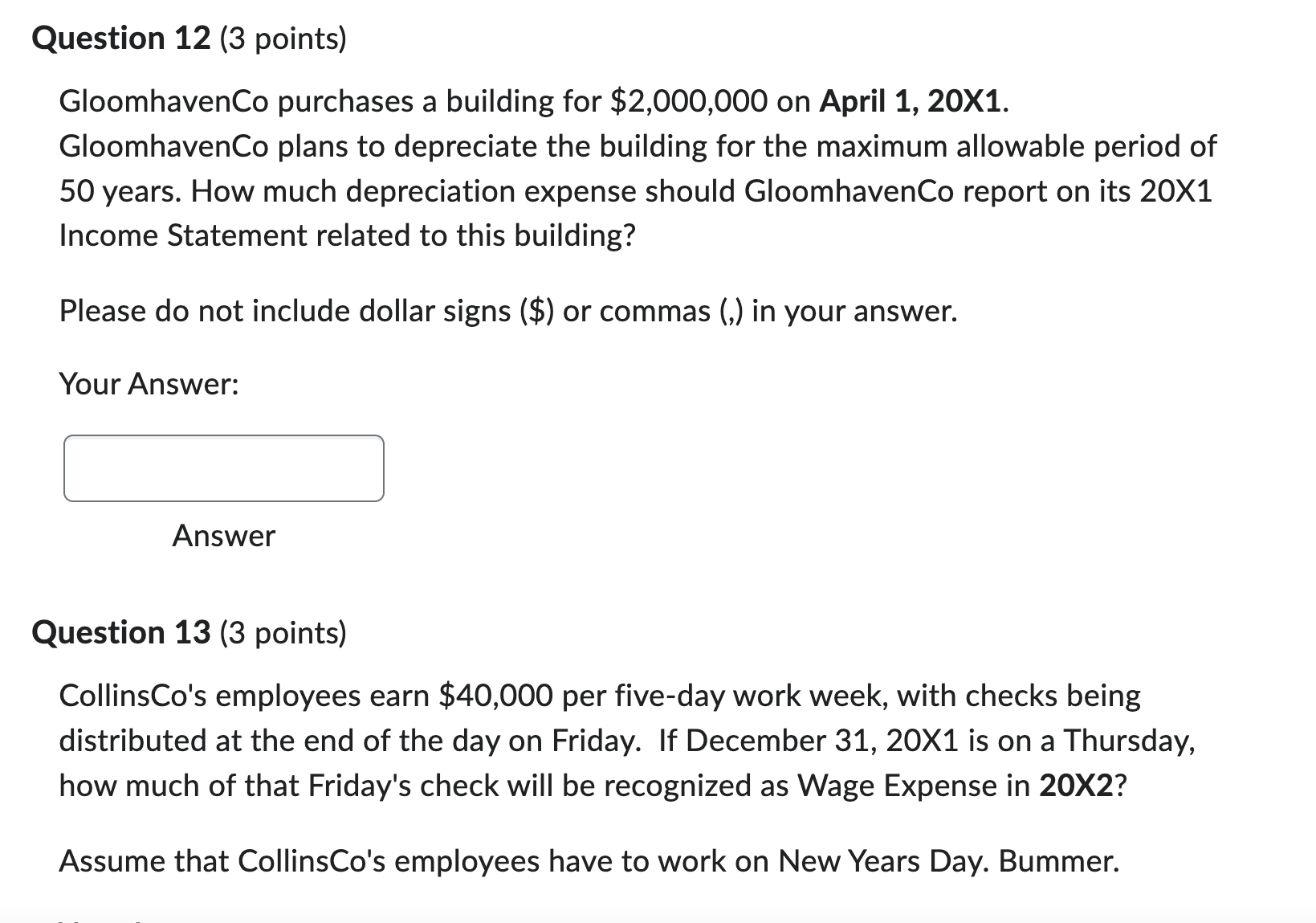

GloomhavenCo purchases a building for \$2,000,000 on April 1, 201. GloomhavenCo plans to depreciate the building for the maximum allowable period of 50 years. How much depreciation expense should GloomhavenCo report on its 20X1 Income Statement related to this building? Please do not include dollar signs (\$) or commas (,) in your answer. Your Answer: Answer Question 13 (3 points) CollinsCo's employees earn $40,000 per five-day work week, with checks being distributed at the end of the day on Friday. If December 31, 20X1 is on a Thursday, how much of that Friday's check will be recognized as Wage Expense in 20X2? Assume that CollinsCo's employees have to work on New Years Day. Bummer. Accumulated Other Comprehensive Income includes unrealized gains and losses that do not otherwise show up on a corporation's Income Statement. True False Question 17 (2 points) Accumulated Other Comprehensive Income is a mess and you're happy you don't have to spend too much time thinking about it. True False Question 18 (2 points) When a corporation purchases Treasury Stock, the transaction reduces Cash and Equity. True False

GloomhavenCo purchases a building for \$2,000,000 on April 1, 201. GloomhavenCo plans to depreciate the building for the maximum allowable period of 50 years. How much depreciation expense should GloomhavenCo report on its 20X1 Income Statement related to this building? Please do not include dollar signs (\$) or commas (,) in your answer. Your Answer: Answer Question 13 (3 points) CollinsCo's employees earn $40,000 per five-day work week, with checks being distributed at the end of the day on Friday. If December 31, 20X1 is on a Thursday, how much of that Friday's check will be recognized as Wage Expense in 20X2? Assume that CollinsCo's employees have to work on New Years Day. Bummer. Accumulated Other Comprehensive Income includes unrealized gains and losses that do not otherwise show up on a corporation's Income Statement. True False Question 17 (2 points) Accumulated Other Comprehensive Income is a mess and you're happy you don't have to spend too much time thinking about it. True False Question 18 (2 points) When a corporation purchases Treasury Stock, the transaction reduces Cash and Equity. True False