Other questions asked by students

Biology

Electrical Engineering

Biology

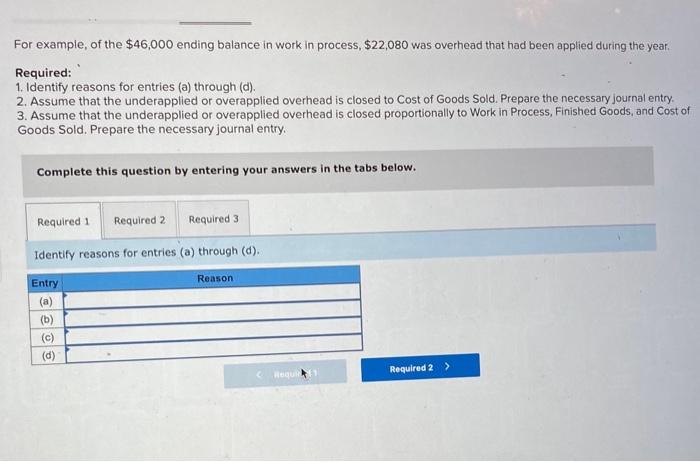

Accounting

Accounting

Accounting