Other questions asked by students

Basic Math

Basic Math

Basic Math

Calculus

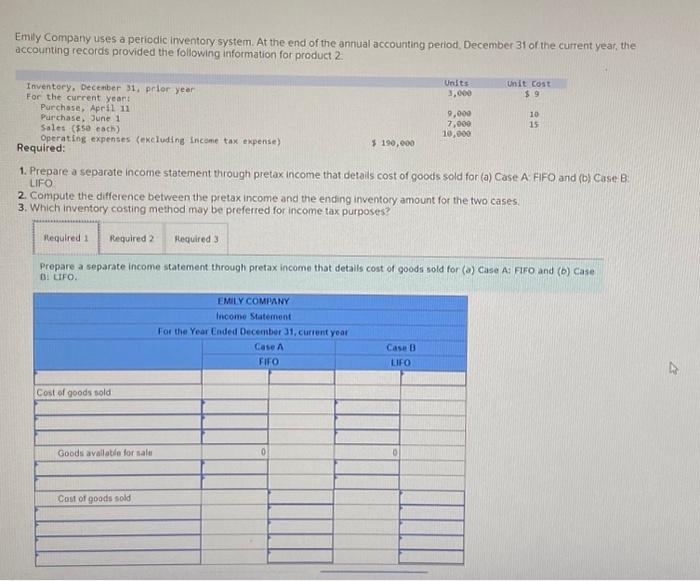

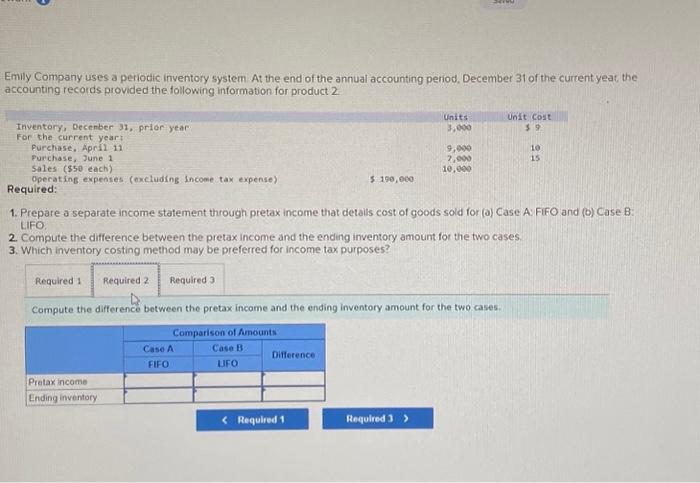

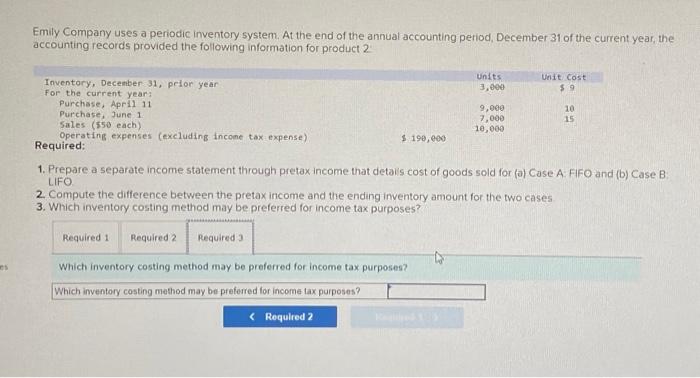

Accounting