During 2023, Rick and his wife, Sara, had the following items of income and expense...

70.2K

Verified Solution

Question

Accounting

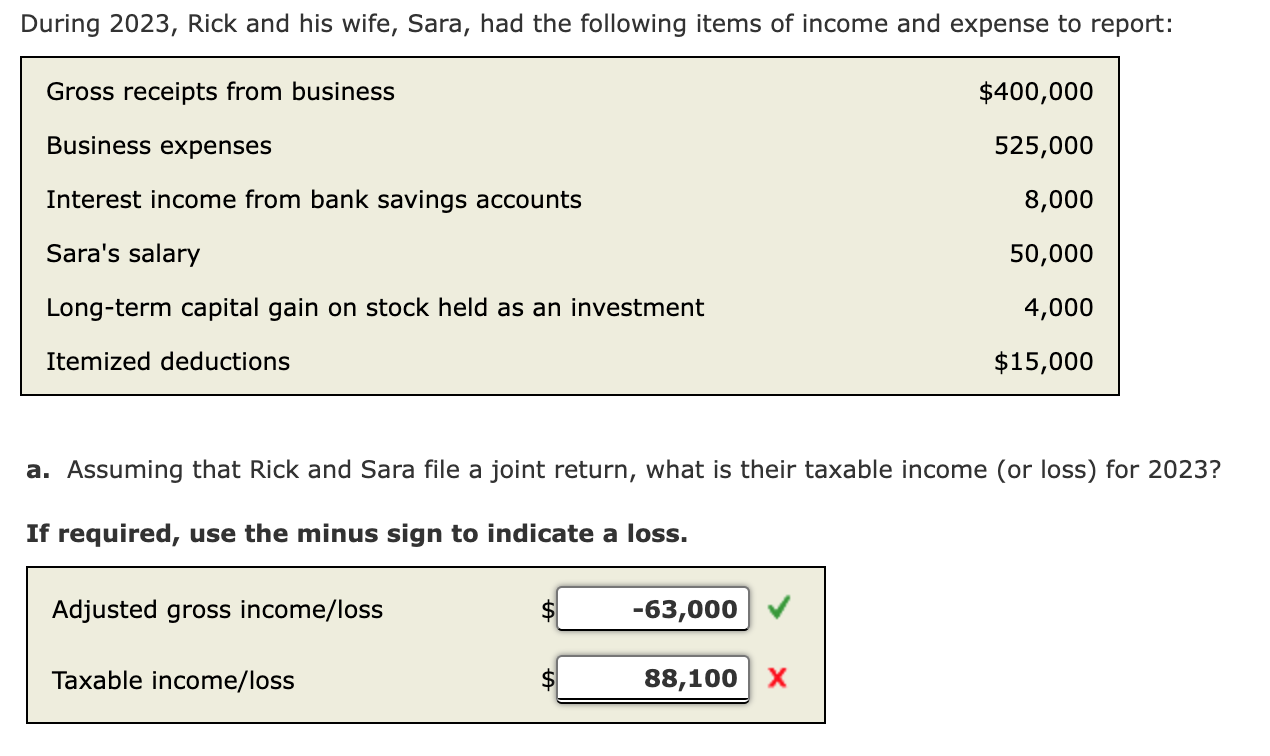

During 2023, Rick and his wife, Sara, had the following items of income and expense to report: Gross receipts from business $400,000 Business expenses 525,000 Interest income from bank savings accounts 8,000 Sara's salary 50,000 Long-term capital gain on stock held as an investment 4,000 Itemized deductions $15,000 Question Content Area a. Assuming that Rick and Sara file a joint return, what is their taxable income (or loss) for 2023? If required, use the minus sign to indicate a loss. Adjusted gross income/loss $fill in the blank 72eac9fbd000057_1 Taxable income/loss $fill in the blank 72eac9fbd000057_2 Question Content Area b. What is the amount of Rick and Sara's NOL for 2023? Rick and Sara's NOL for 2023 is $fill in the

a. Assuming that Rick and Sara file a joint return, what is their taxable income (or loss) for 2023 ? If required, use the minus sign to indicate a loss. b. What is the amount of Rick and Sara's NOL for 2023? Rick and Sara's NOL for 2023 is \$ X

Get Answers to Unlimited Questions

Join us to gain access to millions of questions and expert answers. Enjoy exclusive benefits tailored just for you!

Membership Benefits:

- Unlimited Question Access with detailed Answers

- Zin AI - 3 Million Words

- 10 Dall-E 3 Images

- 20 Plot Generations

- Conversation with Dialogue Memory

- No Ads, Ever!

- Access to Our Best AI Platform: Flex AI - Your personal assistant for all your inquiries!

Other questions asked by students

StudyZin's Question Purchase

1 Answer

$0.99

(Save $1 )

One time Pay

- No Ads

- Answer to 1 Question

- Get free Zin AI - 50 Thousand Words per Month

Unlimited

$4.99*

(Save $5 )

Billed Monthly

- No Ads

- Answers to Unlimited Questions

- Get free Zin AI - 3 Million Words per Month

*First month only

Free

$0

- Get this answer for free!

- Sign up now to unlock the answer instantly

You can see the logs in the Dashboard.