Other questions asked by students

Q

Relation between the collector current gain and emitter efficiency and transport factor for bjt ??

Electrical Engineering

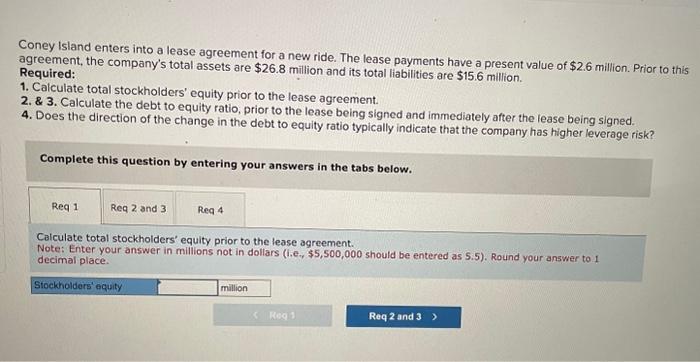

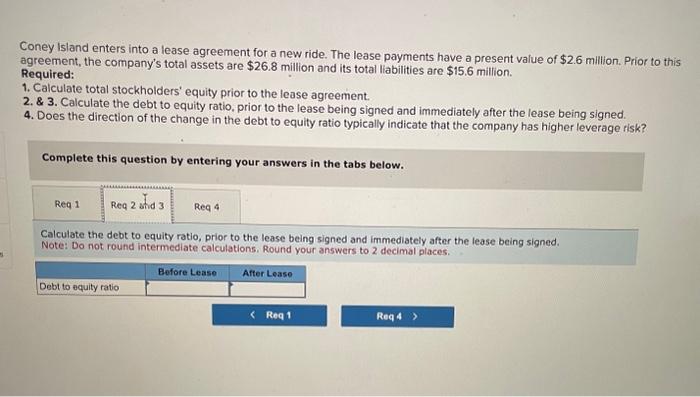

Accounting

Accounting

Accounting