Other questions asked by students

Basic Math

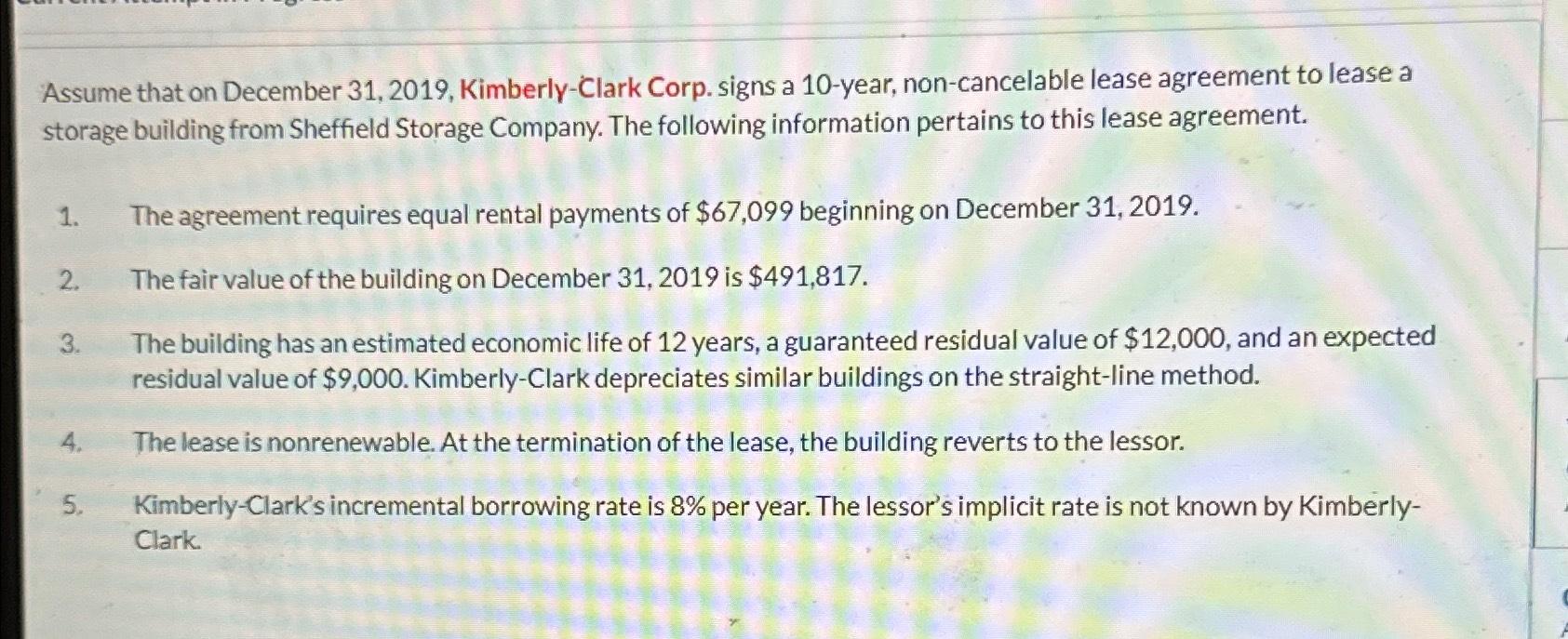

Accounting

Accounting

Accounting

Accounting