Other questions asked by students

Statistics

Advance Math

Accounting

Statistics

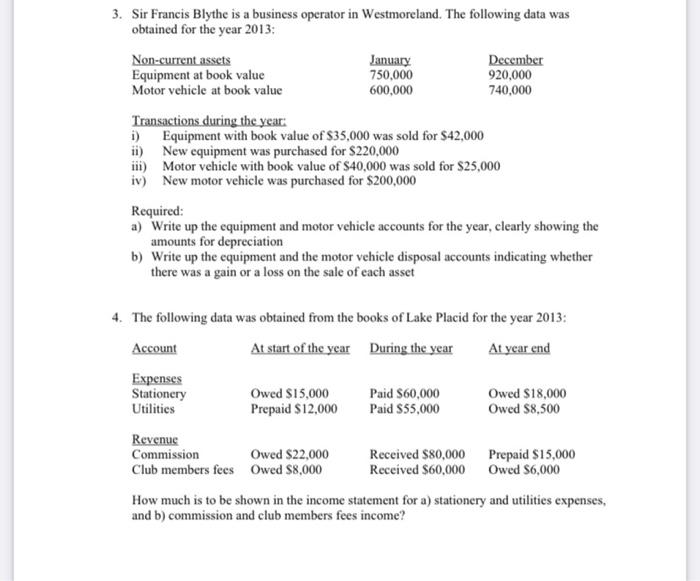

Accounting

Accounting

Accounting

Accounting