Other questions asked by students

Biology

Chemistry

Programming

Calculus

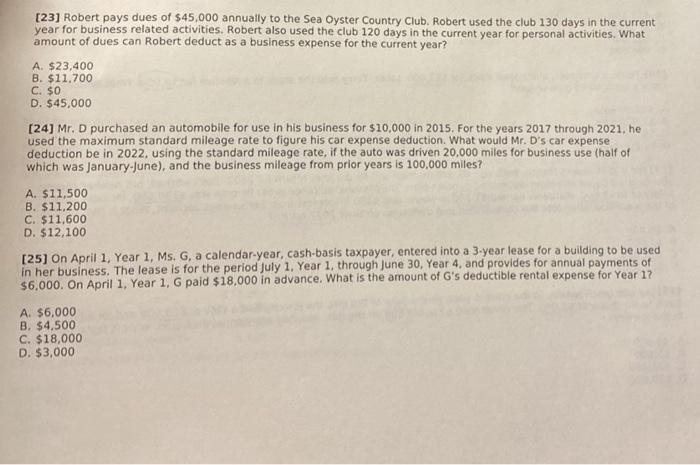

Accounting

Accounting