Other questions asked by students

Electrical Engineering

Basic Math

Basic Math

Accounting

Accounting

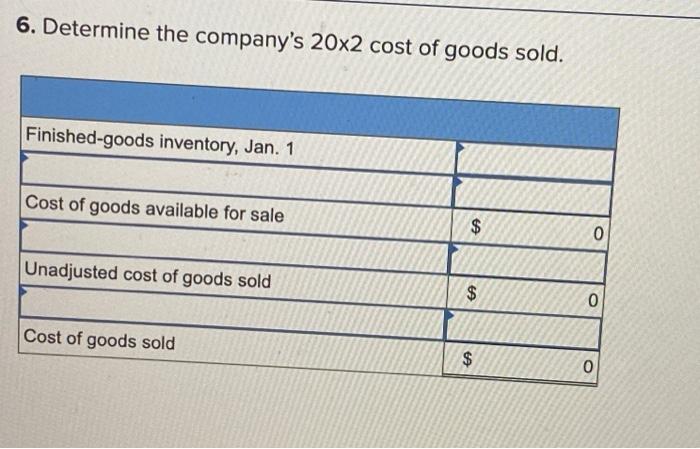

Accounting